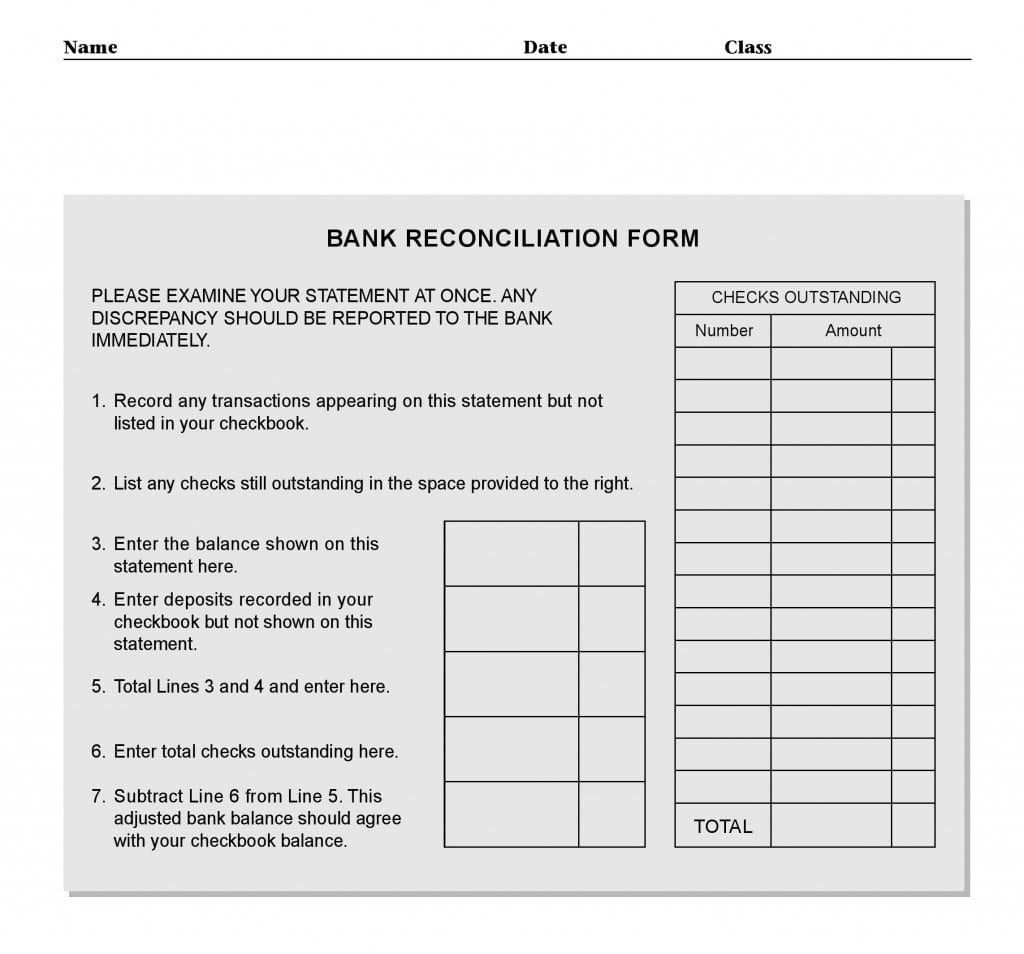

Bank Reconciliation Form offers a solution to match the transactions in the company’s book of account and bank account. This form has spaces for mentioning various transactions like outstanding checks, deposits in the transfer, etc.

Using this form is very necessary for concluding the book of accounts with the right entry of transactions. Bank Reconciliation Form therefore is necessary for the bank reconciliation process to prepare an accounting statement to determine the difference between bank account cash balance and company cash account cash balance. Preparing the Bank Reconciliation Form is necessary as certain financial transactions like deposits in transit and outstanding checks do not reflect in bank statement.

Similarly, income from interest, service charges, and NFS checks does not reflect in company’s cash account although they reflect in the bank statement. However, you must report discrepancies to bank immediately upon observing them in Bank Reconciliation Form. Using this form helps in understanding various transactions and balancing adjustments in bank’s balance. The conclusion derived using Bank Reconciliation Form results in matching the adjusted bank balance with the company cash balance. The form has two columns and requires input of transaction amounts and computations in the manner directed in it. Prepare Bank Reconciliation Form carefully to avoid errors, omissions, and strikeouts.

Steps To Prepare Bank Reconciliation Form

- Please follow step by step instructions for computing the adjusted bank balance. Directions for each computation are provided as and when necessary.

- Enter name, date, and class on the first line of the Bank Reconciliation Form.

- Enter all transactions appearing on the bank statement but not mentioned in the checkbook. You may choose to use a separate sheet for recording multiple entries. This amount must match with the balance on the bank statement.

- Then mention the number and amount of each outstanding check in the column provided on the right. Please use separate line for each unpaid check entry.

- Enter the statement balance as mentioned in the bank statement issued by your bank on line 3.

- Enter the amount of deposit not reflecting in the bank statement on line 4. This amount must reflect in your checkbook. Typically, amounts for transit deposits and outstanding checks reflect in this part of the Bank Reconciliation Form.

- Enter the total of amounts mentioned on line 3 and line 4 on line 5.

- Enter the total amount of outstanding checks on line 6. You can compute the total amount of outstanding checks by addition of the amounts in the column on the right carrying the amounts of outstanding checks.

- Subtract the amount on line 6 from the amount on line 5. The concluding amount points to adjusted bank balance that matches the company’s checkbook balance.

Form Preview