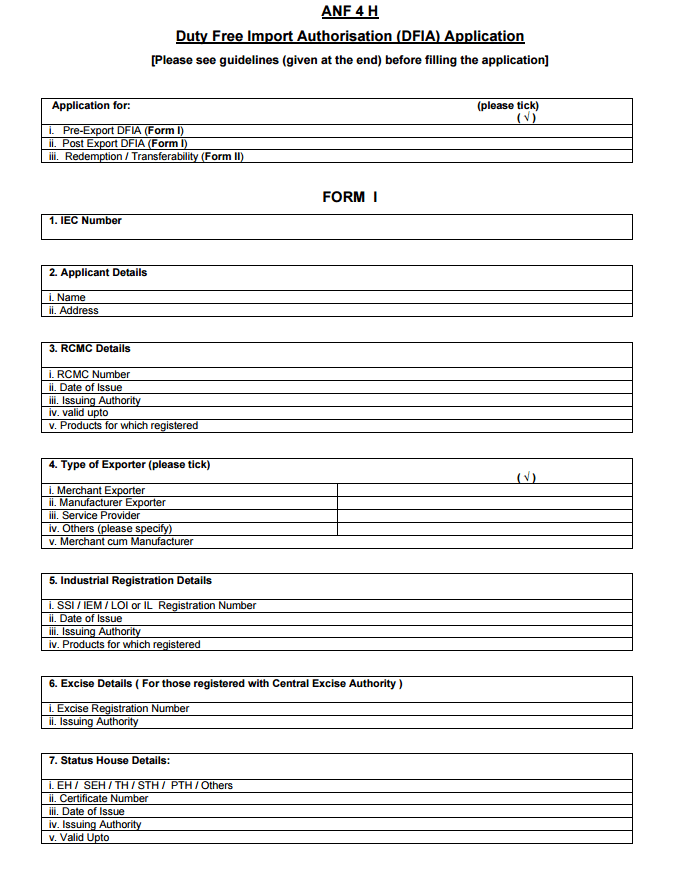

ANF 4 H Duty Free Import Authorisation (DFIA) Application has two forms for Pre and Post Export DFIA and Redemption / Transferability respectively. Please mark your choice in the foremost part of the form to indicate your preference of filing the type of form between these two.

Please review instructions closely before preparing the form. You may need to enclose various supporting documents; particulars of application fee remittance, along with duplicate form ANF 4 H before filing it.

Steps To Prepare ANF 4 H Duty Free Import Authorisation (DFIA) Application

Form I – Pre and Post Export DFIA

- Enter IEC Number in section 1.

- Enter your name and address in section 2.

- Enter RCMC details like RCMC number, date of the issue, name of issuing authority, expiration date, and product description in section 3.

- Provide particulars of Exporter by marking after Merchant Exporter, Manufacturer Exporter, Service Provider, Others, and Merchant cum Manufacturer in section 4. Please describe Others, if you select so.

- Provide Industrial Registration details like registration number for SSI / IEM / LOI, date of the issue, name of issuing authority, and description of products in section 5.

- Enter Excise Registration Number and name of the issuing authority in section 6 when applicable.

- Enter Status House details like EH / SEH / TH / STH / PTH / Others, Certificate Number, Date of Issue, name of issuing authority, and expiration date in section 7.

- Provide details of application fee like amount, bank details, date, and mode of payment in section 8.

- Enter Total CIF value of Imports in INR, currency of import, and US Dollar.

- Enter total FOB/FOR value of Exports in INR, currency of import, and US Dollar.

- Enter Value Addition in percent on the next line.

- Enter particulars of Port of Registration for import purpose.

- Provide requested particulars in section 13 on lines 13i and 13ii.

- Enter the particulars of items exported/supplied under authorisation in section 14. Use separate line for each item.

- Provide particulars of items requested for imported duty free under the authorisation each on a separate line in section 15.

- Complete section 16 only when claiming drawback benefits. Leave blank otherwise.

- Submit the particulars of Outstanding Export Obligation in the next section. Use separate line for each Outstanding Export Obligation.

- Enter the details of the exports / deemed supplies carried out in the last three licensing years in section 18.

- Provide details in section 19 in case exports made under Deemed Exports category.

- Complete section 20 in case of request made for issuance of Invalidation letter/ ARO.

- Enter the address of the premises in section 21.

- Enter jurisdictional Central Excise Authority address in section 22.

- Provide details of supporting manufacturer in case the items imported are used by the same in section 23. Enter name, address, SSI / LOI / IL registration number, date of the supporting manufacturer along with details of the products endorsed on SSI / IL / IEM.

- Sign after the declaration. Enter place, date, name, designation, office and residential address, phone number, and email address to complete preparation of ANF 4 H Duty Free Import Authorisation (DFIA) Application.

Form II – Redemption / Endorsement of Transferability on DFIA

- Select the request type and enter the required particulars on lines Ia through VIb in section 1 of form II.

- Enter particulars of application fee in section 2.

- Provide requested particulars of physical exports / deemed exports carried out each on a separate line in section 3.

- Enter details of Shipping Bill / Invoice Wise Export items in section 4. Use separate line for each detail.

- Provide particulars of imports made against Authorisation in section 5 only during Pre-Export DFIA.

- Provide particulars of excess imports made proportionate versus export obligation fulfilled when applicable in section 6 of form II.

Sign and enter the place, date, name, designation, office and residential address, phone number, and email address to complete preparation of ANF 4 H Duty Free Import Authorization (DFIA) Application.

Application for Duty Free Import Authorization (DFIA) Form

Preview Form