A taxpayer must fill the California Income Tax Return Form 540A correctly and provide supporting documents in line with the requirements referred to in the form. California Income Tax Return Form requires calculations of various heads and instructions for the same are available next to each step requiring calculation.

You must sign this three-page form along with your spouse if both of you are filing the tax return. Complete each section requiring information and calculations accurately. You may seek help from Paid Preparer for filling the particulars in the California Income Tax Return Form. However, you must give details of the Preparer as requested in the form. Page 2 and 3 requires entering your name and SSN on the topmost line.

Personal Details

Begin by providing your personal details like name, SSN or TIN, and address followed by your spouse’s details if your spouse is a co-applicant. Mention your and your spouse’s date of birth on the next line. Enter your last name if filed differently in previous year’s return or leave blank when not applicable.

Mark appropriate response on line 1 through 5 to declare filing status and check the box if your filing status is different for Federal returns and California returns. Check the box on line 6 to declare the status of dependency.

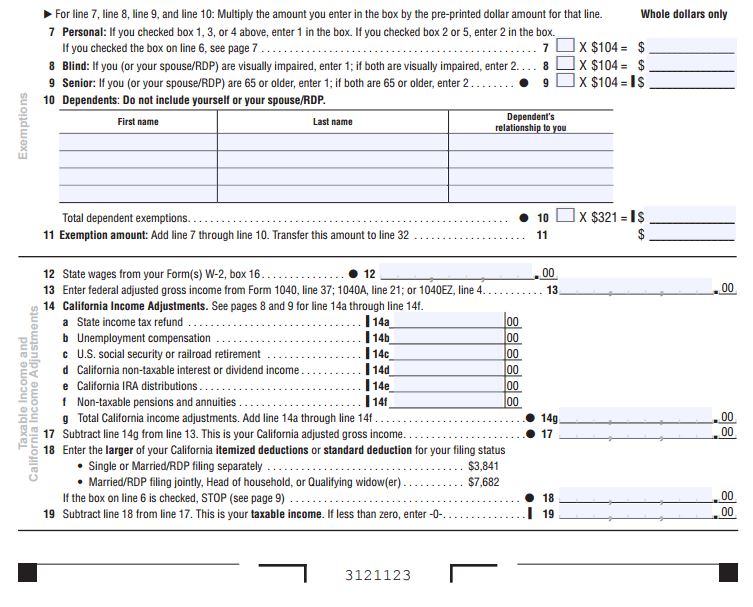

Exemption and Calculations for California Income Tax

Select exemptions on line 7 to 9 by following the instructions and calculate the exemption amount. Mention name and relation with the dependent. Use separate line for each dependant. Calculate total exemption for dependant on line 10. Add values from line 7 through 10 on line 11 and copy the amount on line 32. Calculate taxable income by following the instructions on Line 12 to line 18 and enter the taxable income on line 19. Lines 14.a to 14.f are for California Income Adjustments.

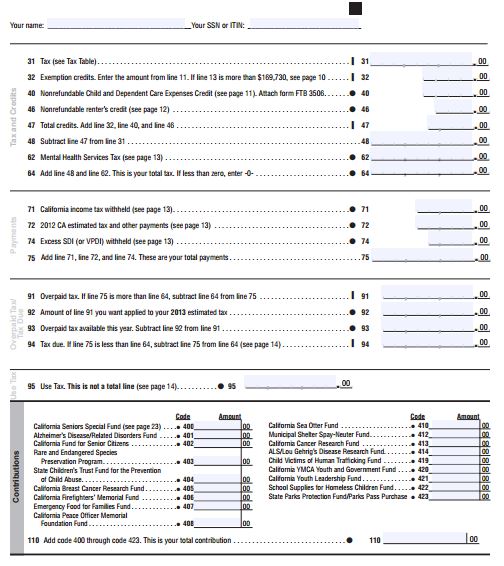

Tax Credits , Payments and Contributions

Continue to page 2 of the form by typing your name and SSN. Complete next section Tax and Credits, by entering values on line 31, 32, 40, 46, 47, 48, 62, and 64. Enter values on line 71, 72, and 74 to enter total payments on line 75.

The subsequent section of California 540A Resident Income Tax Return seeks input of values on line 91 and 92 for computing overpaid tax or tax due. Type the value on line 93. Follow instructions on line 94 and enter the value of tax due. Enter value of Use Tax on line 95. Next section Contributions requires input of applicable amounts on line 400 to 423. Add from line 400 through 423 and enter the amount on line 110 to calculate the total contribution.

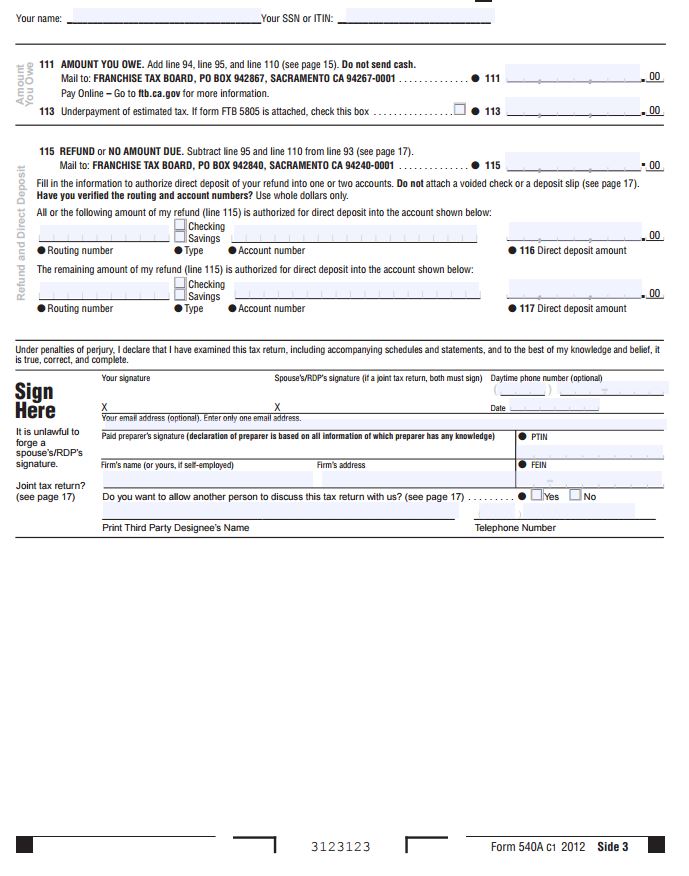

Amount You Owe , Refund and Direct Deposits and Signature

Proceed to page 3 of California 540A Resident Income Tax Return and enter your name and SSN on the topmost line. Calculate the amount you owe by calculating as directed on line 111 and enter the amount. Select the box on line 113 if form FTB 5805 is enclosed for underpayment of estimated tax. Next section Refund and Direct Deposit requires calculating as instructed on line 115 to calculate a refund if any. Enter the total after calculation on line 115. Provide authorization for direct deposit by providing routing number, bank account type, and account number along with direct deposit amount on line 116. You may provide information on line 117 for direct deposit of the remaining amount to your bank account.

You and your spouse must sign and insert date in the space provided. You may provide a daytime phone number optionally. Continue by Paid Preparer’s signature, provide Firm’s name, and address along with PTIN and FEIN when applicable. You may designate a third party for tax matter discussions by marking your response yes and provide third party’s name and phone number and select no otherwise to complete filling California 540A Resident Income Tax Return.