Any owner of taxable property must file Darien, Connecticut 2015 Declaration of Personal Property – Short Form to declare the assets to the Assessor. Please read this four-page form carefully before preparing and filing it. Connecticut General Statutes §12-50 permits the owner of the taxable property to appoint an agent to represent him/her before the Assessor.

Financial and commercial information provided in this form is not available for public inspection. You must date and sign this form before filing it. Alternately, your appointed agent must date and sign this form. Form with improper or missing signature attracts penalty. Handover or mail duly completed form to the Town of Darien, Assessor’s Office, Darien, CT 06820-5397.

Steps to prepare Darien, Connecticut 2015 Declaration of Personal Property – Short Form

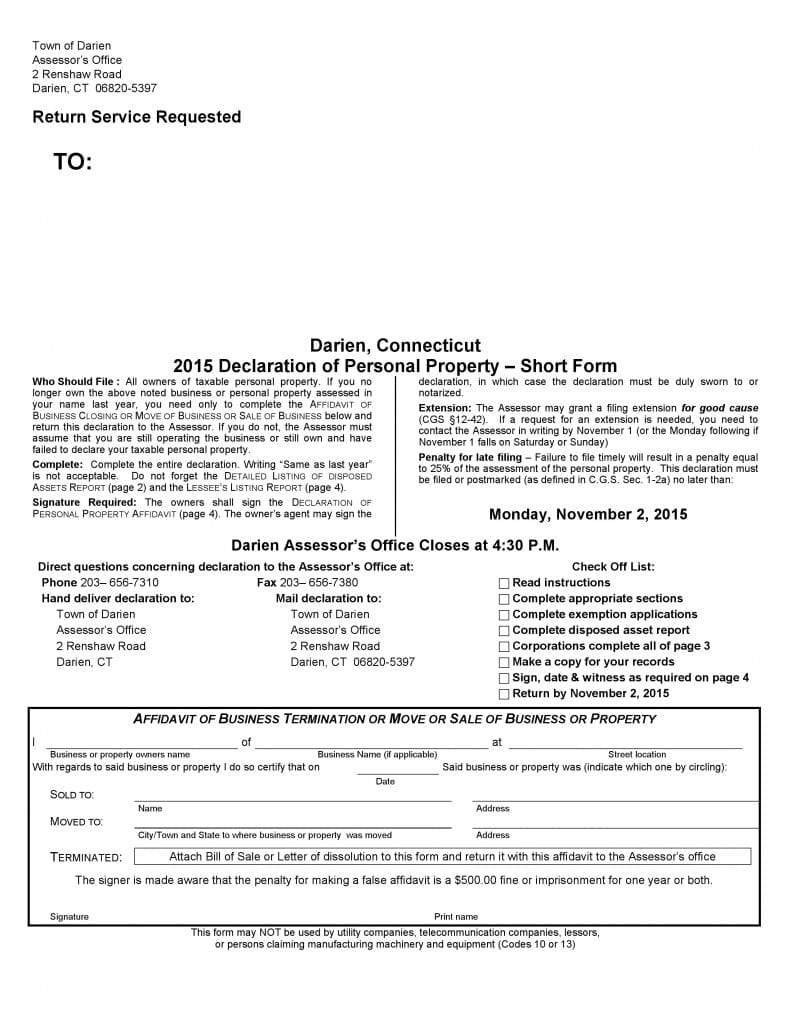

Darien, Connecticut 2015 Declaration of Personal Property – Short Form

Affidavit of Business Termination or Move or Sale of Business or Property

Prepare and file this Affidavit of Business Termination or Move or Sale of Business or Property in case you have sold, moved, or terminated the business assessed in the previous year. Enter the required details, date, and sign before the printed name.

2015 Personal Property Declaration – Short Form

- Provide actual acquisition costs for taxable property by entering information from the year 2009 till date. Please use the left column of entering information about Commercial Fishing Apparatus or Farm machinery and the right column for farm tools or mechanics tools. Please circle appropriate choice.

- Provide information about furniture, fixtures, and equipment on code 16. Enter the particulars of electronic data processing equipment under code 20. Enter details of expensed supplies under code 23. Continue by providing particulars of other goods under code 24a and rental entertainment medium under code 24b.

- Complete the next portion of the 2015 Personal Property Declaration – Short Form by providing detailed Listing of Disposed Assets Report. You must enter particulars like date of removal, applicable code, item description, date of the acquisition, and cost of acquisition for each item disposed.

- Continue by entering List or account number, owner’s name and address, DBA name if any, phone number, street location of personal property, business description, and email address on the respective lines.

- Specify type of ownership and business by selecting the right box on the following lines.

- Furnish particulars of IRS Business Activity Code, square footage, and number of employees in the respective spaces on the next line.

- Enter the particulars of unregistered motor vehicles under code 9. Continue by entering details of horses and ponies under code 11 and mobile manufactured homes under code 14.

- Enter the requested details of the property code and description from code 12 through code 24 and provide total assessment subtotal. Enter 25% penalty amount, if any under code 25.

- Select applicable exemptions by marking the appropriate boxes from 7 options under the Exemptions section.

- Enter lessee’s name and select the correct boxes to give particulars of disposed leased items. Then provide details of lease 1, 2, and 3 like lessor’s name and address, lease number, description of the item, serial number, year of manufacturing, select if capital lease, lease term, rent, cost of acquisition, and year included.

Declaration of Personal Property Affidavit

Select your role, enter date, and sign above your printed name in section A if you are filing this Darien, Connecticut 2015 Declaration of Personal Property – Short Form on your own. Alternately, your appointed agent must sign and date Section B after entering printed name. However, the agent must sign before a witness and he/her must acknowledge the same by signing on the last line after entering the date.

Preview