Application for Residence homestead exemption is a legal application to ask for homestead exemption. In case you’re wondering, what a homestead exemption is; it is a legal document that has been designed to protect the principal value of home belonging to the residents from the creditors, property taxes and also in situations where the homeowner or the spouse dies. The United States and other countries have specific laws regarding the homestead exemption.

How is a Homestead different from the whole residence?

A homestead can just be a condominium, a manufactured home, a rented land or a leased land (within 20 acres), a separate structure as long as a single individual is owning it. The thing about homestead exemption is that irrespective of what kind of land, the owner should be using it for residential purpose. Only in such cases, you will have the possibility of applying for homestead exemption based on your resident. This exemption removes a certain part of the principal value of the home to be covered by taxation or any other kind of billable and thus helps in reduction of taxes. Imagine that you own a house of principal value, $100,000 and you have got qualified for an exemption of $25,000. You will be paying taxes for the rest $75,000 only.

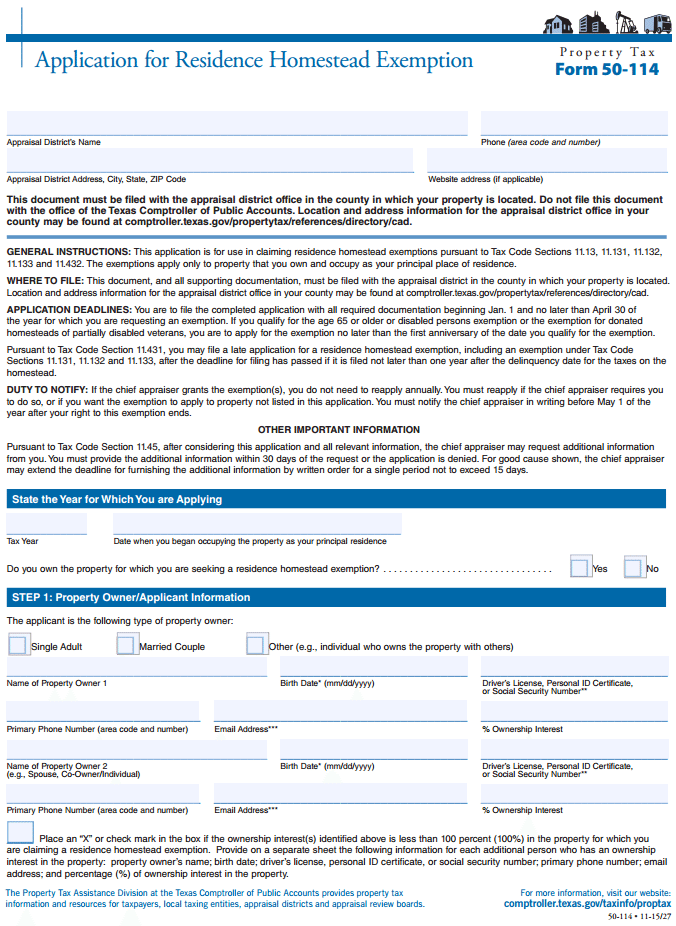

Step by Step form to fill Application for Residence Homestead Exemption

- Application for Residence homestead exemption is a five page document to be filled in order to acquire a homestead. The first step contains information about the Property Owner/Applicant Information including Name, Phone number, Address, Email Id, Marital status, Social Security Number and % Ownership interest. You may have to fill details about two people, both the Owner one and Owner two.

- The second part contains details about ‘Property that Qualifies for Residence Homestead Exemption’. Here you have to fill the legal information of the property, the physical address, no of acres, model and ID number of the home.

- The third step of the document is about ‘Types of Residence Homestead Exemptions’. Here you have to mark a cross in the rectangular box provided beside the option you’re applying as a homestead exemption. In case your spouse is dead, you have the mention his name, details of death and date of the death.

- The 4th and 5th part of the documents are about ‘Tax Limitation or Exemption Transfer’ and ‘Application Documents’. Here, you will cross the options and provide all kind of details that are asked in the document required to apply an exemption.

- The 6th part of the document is ‘Affirmation and Signature’. You have to give the printed name of the owner and sign with initials acknowledging that you’re applying for it under full conscience and right sense of mind with date and should get it signed by a notary public as an affidavit.

Application for Residence Homestead Exemption (Form 50-114)

Form Preview