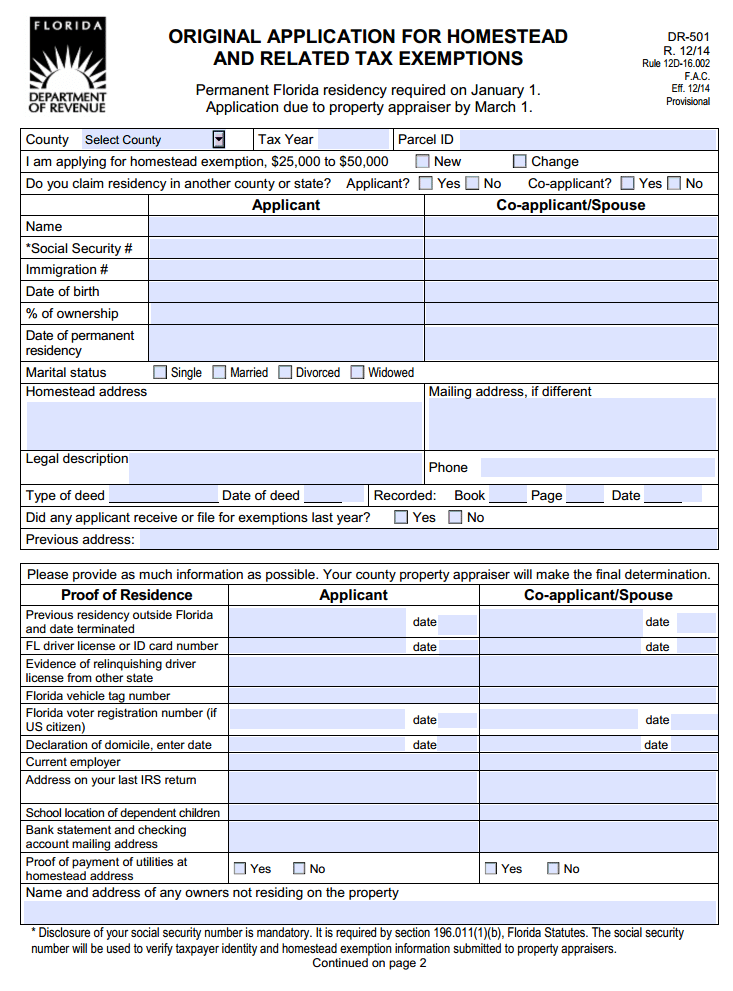

A Florida homestead exemption application DR-501 (12/14) form is a licit document that allows the residents of Florida to apply for Homestead Exemption on their residential properties. Be it a condominium, co-op apartment, mobile home, an open land, a part of the individual house; anything that functions have a home as long as it is owned by a single individual.

The constitution of Florida is going to provide an exemption from tax for the first and third $25,000 of the principal value of the home if it is owned or occupied.

Though the formula seems complicated to explain, you should know that the extra $25,000 would be applied to the non-school portion of the tax that has been billed. In a nutshell, if you own a home that has a principal value of $75,000 or higher, you will have an exemption of around $650 – $1100 in your tax, according to the 2015 bills. Each year, the exemption is done by January 1, as a determination of your residential status whether it is temporary or permanent.

Systematic procedure to Fill Florida Homestead Exemption Application Form

This application is a 2-page application form Both pages must be submitted to make the application complete. Your application once finished and marked, might be sent, faxed or recorded in individual at one of our workplaces by March 1.

- Tax Year – Enter the qualified year you are looking for estate exclusion.

- Package ID – Enter the 10 digit Folio Number or 22 digit PIN number [property search]

- Check one: New is for a first time application. Option is for adding an exception or candidate to a built up residence exclusion on record.

- Check yes or no – on the off chance that you have own a home in whatever other state or district that is getting the estate refund, electrical switch, or guideline home advantage.

- Give the name for any proprietor who is applying for the exception and complete the accompanying inquiries for every individual:

- The Government managed savings Number (when the proprietor is hitched and the life partner is not recorded as a proprietor, we are required to have the life partner’s Social Security Number)

- Movement # – on the off chance that you are not a US Citizen, conception or naturalized, incorporate your 9-digit number (Axxx-xxx-xxx). Connect a duplicate of the Permanent Resident Card, both front and back.

- Date of Birth d. Date of Occupancy – the date you moved to or came back to the subject property after a nonattendance followed by Conjugal Status

- Location of the home you are guaranteeing as your main living place (site location of the property, which you are applying for estate exclusion) Postage information, if not the same as the main living place address.

- Phone Number – give us a daytime number where we can contact you, if there are inquiries.

After being done with these, the rest of the form asks for details like duty exception, your location on 1st of January that year, Driver License Number, Employer ID, Voter Registration number, Address on IRS etc. If there are any individual changes you want to accommodate, you can do it in page 2 and sign the form respectively, with date and your initials.

Florida Application for Homestead and Related Tax Exemptions (DR-501)

Form Preview