CFPB or Consumer Financial Protection Bureau mandates filing financial information in Equator after the initialization of a short sale. This financial information is necessary during the evaluation. Bank of America Financial Information task in Equator form has four pages requesting information from the borrower as well as co-borrower of Monthly Expenditures, Total Income, and Unencumbered Income along with debt and other expenditures.

Filling this form is easy; however, you need to gather all the required financial data from various sources on beforehand to avoid delays and errors. Please give accurate information on every page of the form. You may need to specify any other incomes or expenses and provide details of the same as and when required to project truthful and accurate projection of your financial standing. Bank requires this information right after the initialization. You as the principal borrower along with any/all co-borrower/s must provide inputs as and when requested by the form. Mention property address and loan account number carefully in the form.

Steps to prepare Bank of America Financial Information task in Equator

Part I – Income Details

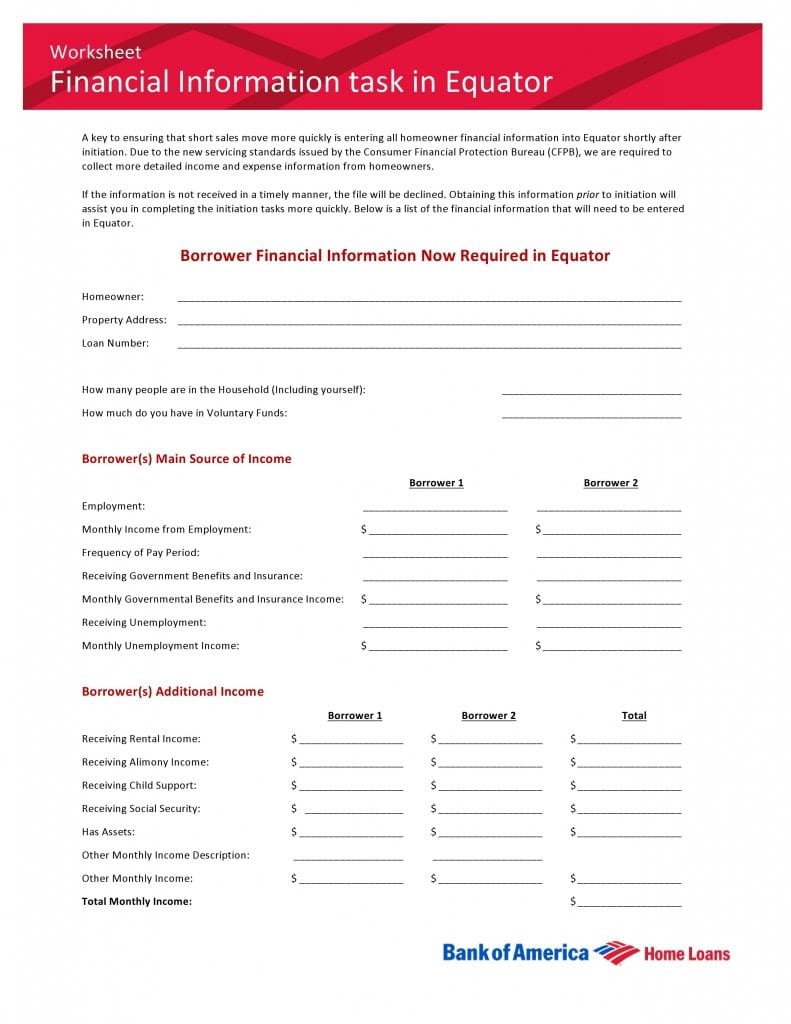

Enter the name of the homeowner followed by property address and loan account number on the first three lines of the Bank of America Financial Information task in Equator respectively.

Enter number of people in your home including you. Then mention the amount of voluntary funds on the next line.

Enter details of borrower’s and co-borrower’s primary income like nature of employment, monthly income, the pay period frequency, particulars and amounts of insurance and government benefits, and particulars and amounts of receiving unemployment benefits. Please use separate lines for borrower and co-borrower.

Enter particulars of surplus income of borrower and co-borrower. You must add each income value after entering the details like rental income, alimony income, amount of child support and social security, and assets along with details and amounts of any additional income on the respective lines. Conclude part I by entering total monthly income on the last line.

Bank of America Financial Information Task in Equator

Part II – Family Expenses

Part II, Family Expenses of the Bank of America Financial Information task in Equator requires input of monthly expense amounts of auto maintenance, food, medical/dental expense, alimony payable, child support payable, entertainment, child care expenses, tuition/school expenses, description and amount of other monthly expenses, and total of all family monthly expenses.

Enter amounts of monthly HOA dues, home repairs, description and amount of other home expenses, and total monthly home expenses on the respective lines.

Then enter monthly utility expenses like cable TV, electricity, natural gas, phone/internet, sewer/water, other utility expenses, and total of all utility expenses.

Enter monthly work related expenses like dry cleaning, parking, union dues, any other expenses, and total of all expenses under this head.

Enter the amount of the insurance premium payable for auto, health, and life insurance along with its total.

Enter your monthly contributions for charity, church, and other as applicable on respective lines along with the total of the same.

Enter credit card payment details for all credit cards you own. Add all amounts to enter the total of the monthly credit card debt.

Enter particulars of first and second lien payment, student loan, and any other loan along with the total of the same.

Provide details of assets like home, 401K accounts, checking account, automobiles, IRA/KEOGH accounts, savings accounts, stocks/bonds, motor homes and RVs, and real estate along with other assets if any and total of all assets.

Enter amounts of monthly expenditure, income, unencumbered income, and debt on the respective lines of Financial Summary part of Bank of America Financial Information task in Equator.

Form Preview