Discharge of Guarantor Form is a legal template and source guidelines to prepare a document to release the guarantor from the direct or indirect liability of loan repayment. This form is prepared and signed by the creditor to express the release of the guarantor from the obligation.

Execution of this document is necessary in various financial applications when the borrower repays the loan in full and the borrower and the guarantor are parties to the guarantee of repayment. Execution of Discharge of Guarantor Form is mutual between the creditor, borrower, and the guarantor. The guarantor may seek the discharge from the guarantee under various grounds. You may enclose a copy of the loan agreement along with the form. Please handover copies of the duly filled discharge form to all concerned parties and retain your copy in a safe place.

Before You Start

- Please specify the nature of the guarantee in its appropriate form in this Discharge of Guarantor Form.

- Creditor must date and sign this discharge form for releasing the guarantor from the direct and/or indirect obligation of the loan repayment.

- Please mention the loan amount in US dollar to document the transaction of discharge from the guarantee.

- Type or print this form for legibility. Notarization of the signature and/or identity of the creditor is not necessary unless the guarantor insists the same.

- This Discharge of Guarantor Form serves as a loan termination letter as well as discharge of a guarantor from the guarantee.

- You may choose to mention the nature of loan repayment as evidence in this form.

- This Discharge of Guarantor Form is legally binding on all concerned parties.

How to Prepare Discharge Of Guarantor Form

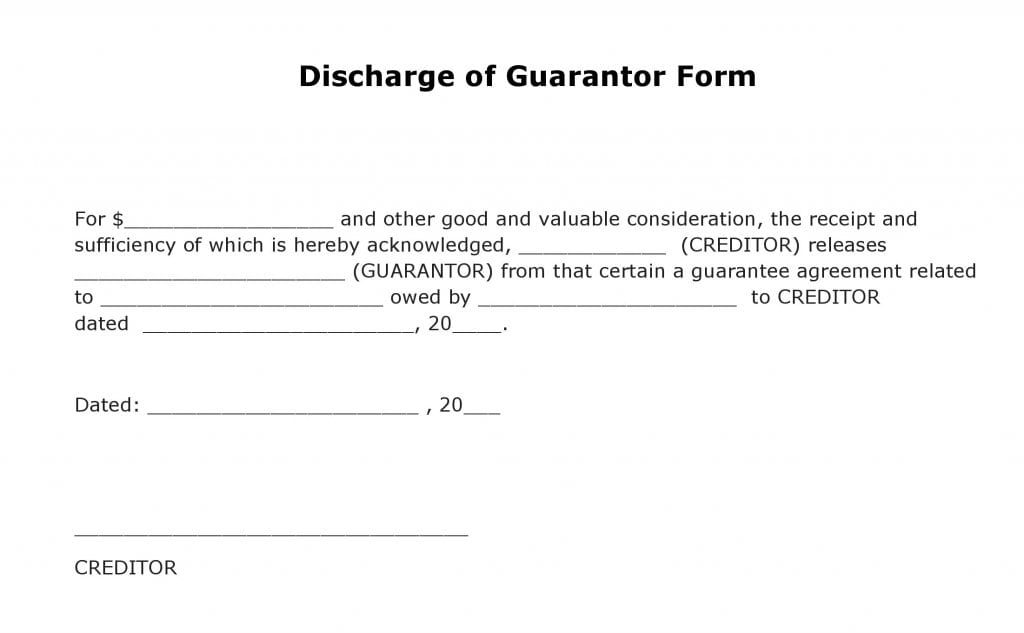

Step 1: Enter the amount of loan in US dollar. You may specify other considerations when applicable.

Step 2: Enter the legal name of the creditor on the next line. You may choose to specify creditor’s name as it reflects in the loan agreement. Please provide title/designation in case the creditor is representing an organization.

Step 3: Enter guarantor’s legal name on the next line as it reflects in the loan agreement.

Step 4: Mention the purpose of the loan on the following line. Ensure to provide an adequate description.

Step 5: Then enter the name of the borrower on the next line. Mentioning these names is very essential to define the roles of the parties to the guarantee.

Step 6: Enter the date of the loan agreement previously signed for recording purpose. You may choose to enclose a copy of the same with this Discharge of Guarantor Form.

Step 7: The creditor must date and sign the form on the respective lines to issue the Discharge of Guarantor Form to the guarantor.

Form Preview