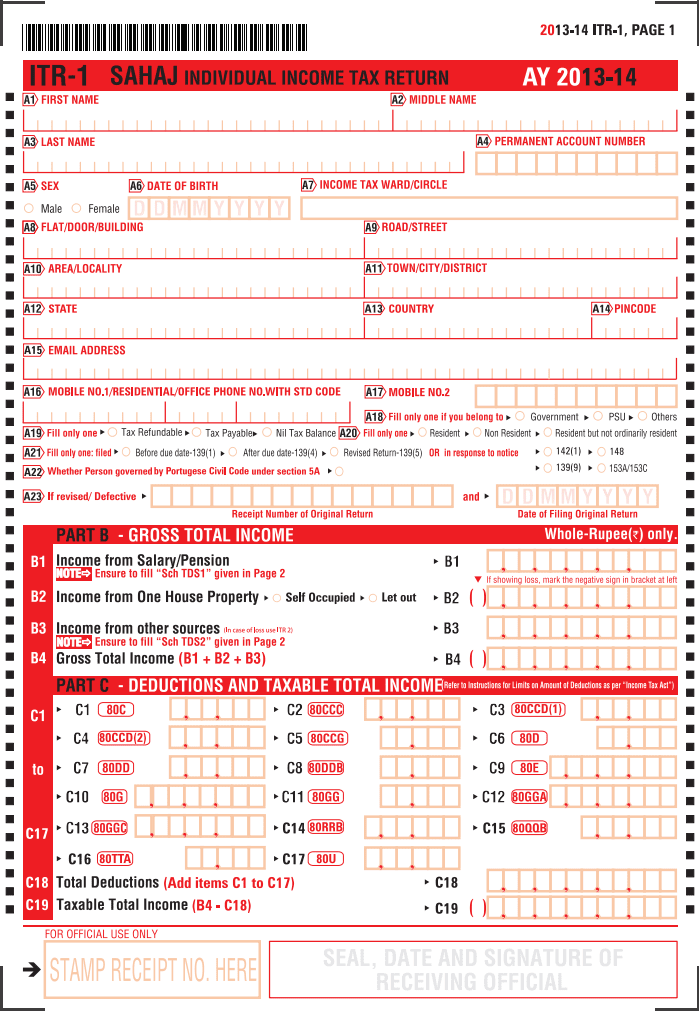

ITR 1 Form Individual Income Tax Return Form facilitates the filing of income tax for salaried individuals. This form is not appropriate for business professionals. Submit duly completed form by print or electronically along with a digital signature, and by submitting bar-coded return. The ITR Form below should be used only by Individuals and not Businesses.

The form is in conformity with the Income Tax Act, 1961. The four-page form has spaces for furnishing various particulars. Circle your choices by filling them completely. None other method of selection is considered acceptable. Provide your PAN and name on all pages of the form where requested furnishing.

Begin by providing first, middle, and last name followed by the PAN or permanent account number. Select Sex, provide date of birth, and furnish Income Tax Ward/Circle. Provide your address in the respective spaces, including pin code. Insert email address on the next line in A15. Furnish mobile/phone number and alternate mobile number in A16 and A17. Select your entity in A18 by circling the appropriate choice. Mark your choice in A19 among three options. Select residential state by circling the right option in A20. Continue by selecting the mode of filing returns by circling one option in A21. Mark circle in A22 if Portuguese Civil Code Section 5A governs you. Use spaces in A23 to provide original ITR and date if applicable.

Proceed to Part B by specifying salary/pension income in B1, income from single home property in B2 and specify if self-occupied or rented by circling appropriate option. Mark negative sign to indicate a loss in B2 and B4 when applicable. Provide income from any other source/s in B3 and continue by specifying gross income in B4.

Furnish deductions if any, in C1 to C17 as applicable and provide relevant sum in C18. Subtract C18 from B4 to insert total taxable income in C19.

Furnish C19 value in D1, specify value for Secondary and Higher Education Cess in D2, and enter the sum of D1 and D2 in D3. Specify relief under section 89 in D4 and provide the balance tax in D5.Continue by providing the amount of interest in D6 to D8 under section 234A. Add D5, D6, D7, and D8 and provide the output in D9. Furnish the amount of advanced tax in D10 if any. Insert self-assessment tax paid in D11. Mention the amount of total TDS claimed in D12. Compute the value for D13 and insert the same by adding D10, D11, and D12. Compute total payable tax as per the guidelines in D14. Provide the refund amount in D15 by subtracting D9 from D13 if D13 is greater than D9. Provide bank account number in D16, circle account type in D17, furnish the ISFC code in D18, and select your preferred mode of refund in D19 by circling one choice between cheque or bank transfer. Provide the amount of exempt income, if any in D20.

Furnish your name, father’s name, place, date, and signature in the verification section. Furnish the particulars of Preparer like name, TRP PIN, amount payable to TRP, and signature of TRP.

Provide BSR Code, date of deposit, challan number, and tax paid in the respective spaces in Sch IT. Use R1 to R5 as necessary and continue to page 5 if more.

Furnish TAN, name of the employer, salary income, and tax deducted in the appropriate spaces in Sch TDS1. Use S1 to S3 to provide particulars and proceed to S4 to S30 on the next page for furnishing more details.

Sch TDS2 seeks particulars of TDS from other sources than salary income. Furnish TAN, the Name of deductor, TDS certificate number, year of the deduction, amount of tax deducted, and provide the amount of tax claimed out of column V in column VI for each deductor. Use lines from T1 to T4 or proceed to T5 to T31 on the next page for more entries.

Form Preview

Form ITR-1 (AY 2013-14)

Instructions – 1 (2013-14)

Form ITR-1 (AY 2013-14) Hindi

Instructions – 1 (2013-14) Hindi