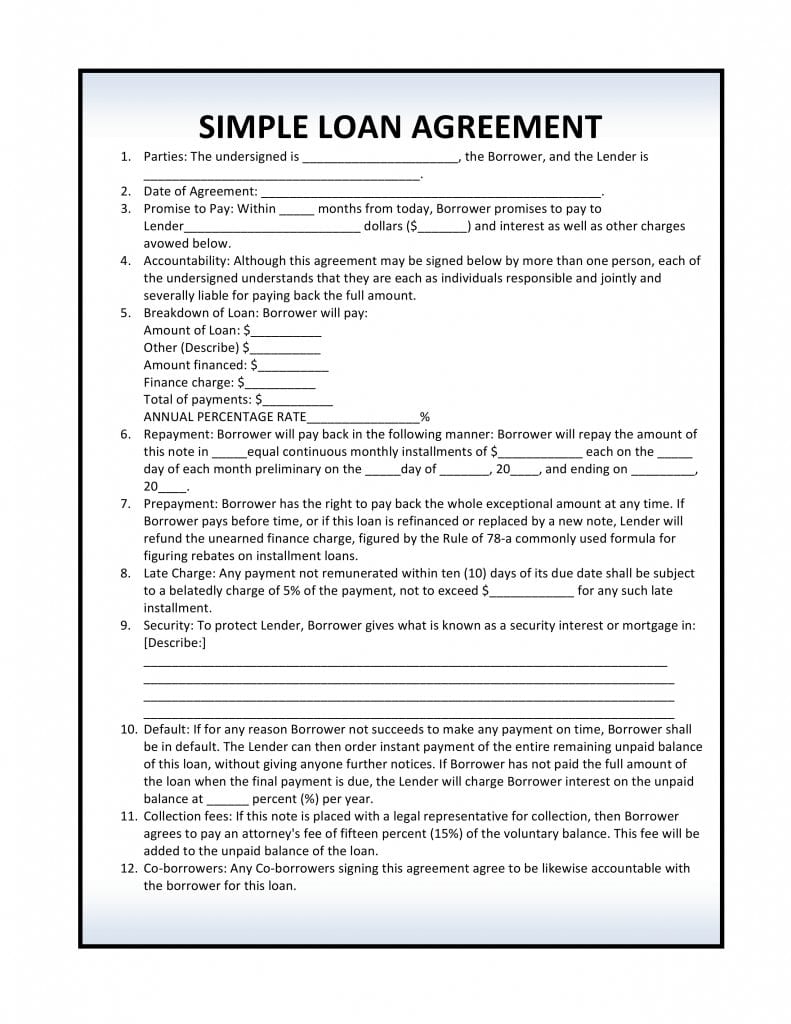

A Simple Loan Agreement allows a lender grant someone else a sum of money for a period of time with the expectation of being paid back. By completing the Simple Loan Agreement the lender and the borrower can agree on the following terms

- Loan amount

- Length of loan

- Amount financed

- Finance charges

- Total of payments

- Annual percentage rate

- Repayment

- Late charge

- Security (A thing deposited or pledged as a guarantee of the fulfillment of the repayment of the loan, to be forfeited in case of default)

- Default (Failure to fulfill the obligation to repay the loan)

- Collection fee

Once both parties have signed and authorized the form it becomes legal.

At Clause 1, the name of the borrower should be entered, followed by the name of the lender. This should be their full names as they appear on their passport or identity card.

The date of the agreement should then be entered in Clause 2 – This date will be the date on which both parties sign the document.

Clause 3 provides the details of the loan agreement: Containing the amount of months the borrower has to repay the loan and the amount of the loan in US dollars written in both words and figures for clarification.

At Clause 5, the lender must breakdown the loan into the following categories:-

- Amount of loan

- Other funds

- Amount financed

- Finance Charge

- Total of payments

- Annual percentage rate

This makes it easier for both the borrower and lender to keep track of what money is attributable to what and what category any claims for later payment can fall under.

The repayment terms of the loan agreement should then be provided. The number of monthly payments, followed by the amount of each monthly payment should be written. The date of the first and last payments should also be entered. It is advisable to enter the month in words for full clarification.

It is at the lenders discretion to add any charge for late payments – If there is to be a charge then this amount should by 5% of the value of the loan, up to a set amount. This amount is chosen by the lender and should be written in clause 8.

If the lender decides to have security over the loan, the details of the object over which the security is provided can be entered in clause 9 – This could be a vehicle or property address etc.

As well as a late payment charge, the lender can issue a charge which is payable if the borrower has not repaid the loan in full by the repayment date. This charge is issued as a percentage of the unpaid amount, and the agreed percentage must be entered in clause 10.

The lender and borrower must then sign the loan agreement on the date to which it takes effect.

Preview Form