Minnesota Bank Authorization for Direct Debit of Tax is in cases where tax return is filed in an electronic manner. This form is not used in case taxes are filled on paper. The form basically gives authority to transfer funds from your account in the amount of tax owed by you.

The amount owed by you is shown in your return filing. The form authorizes the Minnesota Department of Revenue to start debit entries to the account of the person filling the form. This form will remain in effect till the Minnesota Department of Revenue receives a fax or written letter stating the termination. The termination must be made 30 days before the effective date.

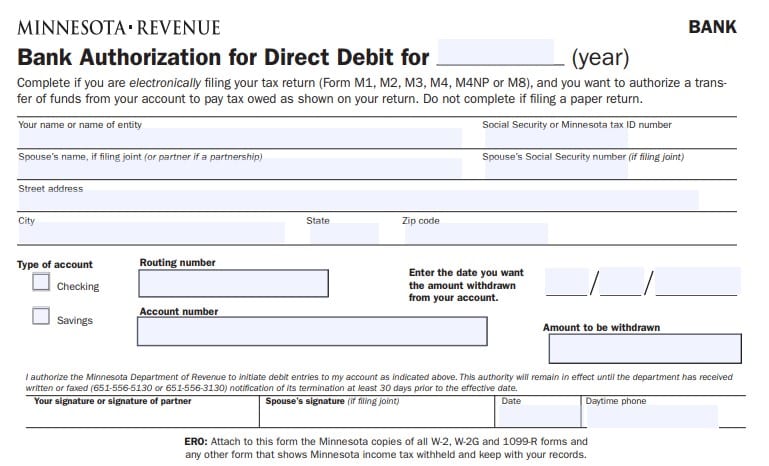

The form starts with a blank space for the current year at the top. Followed by that the form has multiple checking boxes and blank spaces. When filling the form one would be required to write their name or the name of the entity that is giving authority. The names of partners, in case of a partnership, and a spouse, in case the account is a joint account. After the name the complete address of the entity or person must be provided along with the zip code. On the right side one needs to fill in their Social security number or their tax id number specific to Minnesota. Below the person’s social security number, the social security number of their spouse also needs to be filled in case of a joint account.

Below the fill in the blanks there is a checking box. The details regarding the account, whether it is a checking account or a savings account need to be filled. This must be followed by filling the routing number and the account number in the boxes provided. On the right side of the form one needs to fill in the date on which they want the money to be withdrawn. Below it the amount to be withdrawn also needs to be mentioned. The last part of the form requires signatures from the person filling the form. The partner and the spouse, whichever may be applicable. The date and contact number are the last two columns of the form.

Minnesota Bank Authorization for Direct Debit of Tax

This authority will remain in effect until the department has received written or faxed (651-556-5130 or 651-556-3130) notification of its termination at least 30 days prior to the effective date.

Preview Minnesota Bank Authorization for Direct Debit of Tax Form