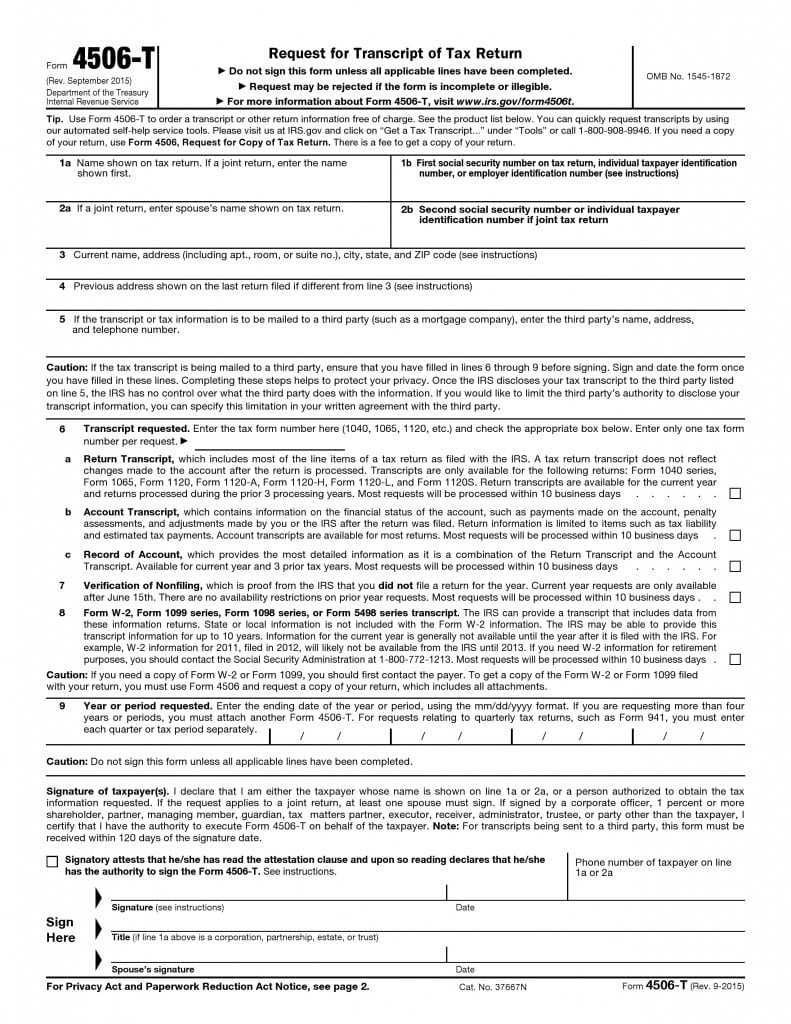

You can request return information from the IRS using form Request for Transcript of Tax Return 4506-T. You may choose to authorize third party to receive this confidential information using the part 5 of this form. Using this facility is necessary during various stages of short sale using Bank of America Tax forms.

Please read the instructions carefully before preparing form 4506-T as requests made using illegible or incomplete forms are rejected by the IRS. Please file this request to the IRS office at TX, CA, MO, UT, or OH depending upon the state you live in. All taxpayers listed in 1a and/or 2a must date and sign this Request for Transcript of Tax Return 4506-T. you may designate a representative using line 5 of form 2848 to sign form 4506-T on your behalf. However, form 2848 must be duly filed with the IRS prior to such request.

Steps To Prepare Request For Transcript Of Tax Return 4506-T

- Preparing Request For Transcript Of Tax Return 4506-T is a crucial step while preparing Bank of America Tax forms.

- Enter the name as it displays on tax returns on line 1a. Please type the first name displayed in joint returns.

- Enter first SSN displayed in the returns on line 1b. Alternately, you may choose to enter the employer identification number or individual taxpayer identification number depending upon the type of information requested.

- Line 2a requires the name of the spouse in case the spouse is co-taxpayer.

- Please enter spouse’s SSN or individual taxpayer identification number on line 2b.

- Please enter your name and detailed address on line 3. Please provide accurate details of the apartment, suite, or room number while entering the address.

- Enter the address as reflects in previous returns if different from the address mentioned on line 3.

- Enter the name, address, and phone number of third party like a mortgage company in case you wish to provide the information requested in this form 4506-T to the concerned third party. You authorize IRS to provide your confidential tax information to the third party using this provision.

- Carefully select options on line 6 and 6a through 6c in Transcript Requested part of the Request for Transcript of Tax Return 4506-T. Enter the tax form number on line 6. Select appropriate boxes on line 6a, 6b, and 6c.

- Select the box on line 7 for Verification of Non Filing, which also serves as a proof of non-filing of the returns of the previous year.

- Select the box on line 8 in case you wish to request transcripts of Form 1099 series, Form W-2, Form 1098 series, or Form 5498 series tax forms.

- Please enter the tax year or the period of requesting the transcript using the space offered on the line 9. You may need to provide quarter of the tax year while requiring transcripts related to quarterly tax returns.

- Mark the box in acceptance of attestation; enter your phone number, title if applicable, date, and sign on the space reserved for the same. Your spouse must date and sign this Request for Transcript of Tax Return 4506-T.

Request for Transcript of Tax Return 4506-T

Form Preview