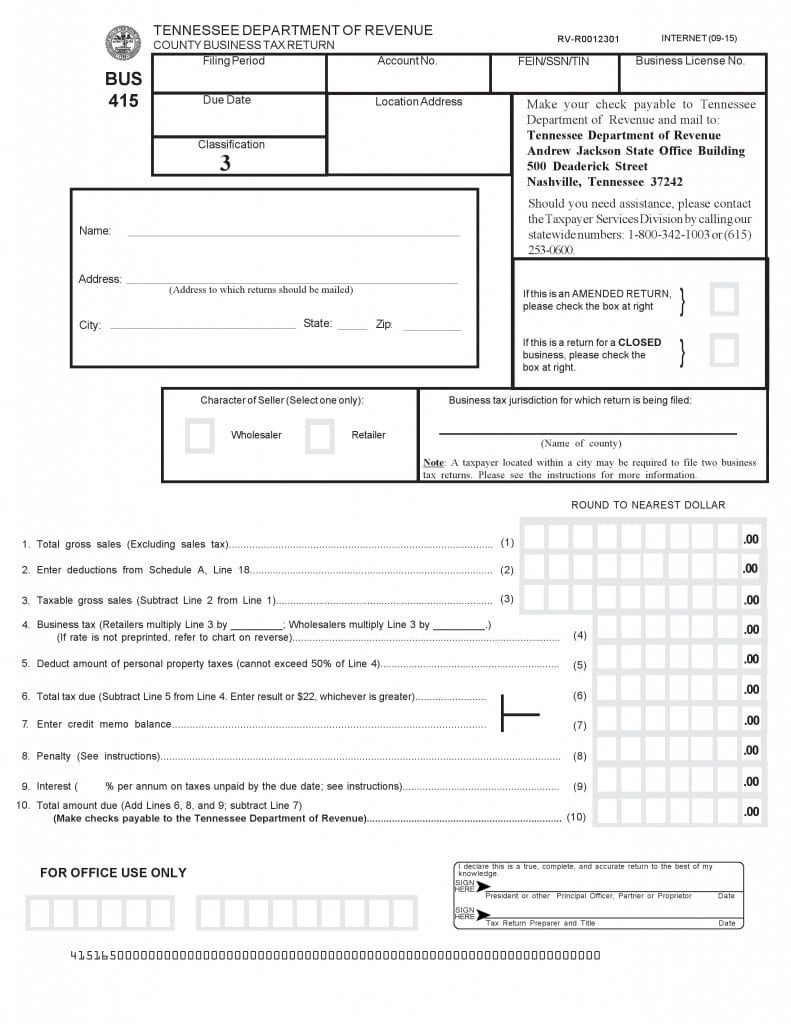

Use RV-R0012301 Tennessee Department of Revenue County Business Tax Return form for filing the county tax returns. Please complete Schedule A, Deductions from Gross Sales duly and file along with RV-R0012301 form at the Tennessee Department of Revenue, Nashville, Tennessee.

Your payment check should be payable to Tennessee Department of Revenue. Please provide all particulars accurately and avoid strikeouts or omissions. You need to enter values and descriptions along with selection of options by marking right boxes. You may choose to prepare this form with the help of a professional preparer. Do not enter any details in the space reserved for office use.

Steps to Prepare RV-R0012301 Tennessee Department of Revenue County Business Tax Return

- Enter filing period, account number, FEIN/TIN/SSN, Business License Number, Due Date, and Location Address in this classification 3 form.

- Enter your name and address for receiving returns. Then select if this is amended return and or you are filing this return for closed business by marking the boxes on the right when applicable.

- Select your business type and business tax jurisdiction on the succeeding lines.

- Please enter amounts rounded to the nearest dollar in the following portions of V-R0012301 Tennessee Department of Revenue County Business Tax Return.

- Enter the amount of Total gross sales without sales tax, and then specify deductions from line 18 of Schedule A. enter taxable gross sales on line 3. Calculate and enter the business tax as directed on line 4. Specify value of the personal property tax on line 5.

- Calculate and enter total tax due on line 6. Continue by providing credit memo balance and penalty on line 7 and 8 respectively. Enter interest amount and total amount due on line 9 and 10. You and preparer if any must date and sign V-R0012301 Tennessee Department of Revenue County Business Tax Return.

Schedule A – Deductions from Gross Sales

- Enter amounts of sales on line 1, 2, and 3. Then enter the amount of the cash discount on line 4. Enter details and amount of repossessions on line 5.

- Specify amount of trade in along with its description on line 6. Describe bad debts and provide total value of bad debts on line 7.

- Enter amount paid for subcontracting as directed in Tenn. Code Ann. Section 67-4-708(4)(A) on line 8 to complete the first portion of Schedule A.

- The next portion Federal and Tennessee privilege and excise taxes of Schedule A requires input of amounts of Federal and Tennessee tax on gasoline, motor fuel, tobacco tax on cigarettes, tobacco tax on all remaining tobacco products, and beer on lines 9 through 13 respectively.

- Specify the amount of Tennessee special tax on petroleum products on the next line. Continue by describing and entering Tennessee liquefied gas tax for motor vehicles on line 15. Specify amount of Tennessee beer wholesale tax on line 16.

- Describe and enter amount of other deductions on line 17. Complete Schedule A by adding values on line 1 to 17 and entering the total deductions on line 18.

Tennessee Department of Revenue County Business Tax Return RV-R0012301

Form Preview