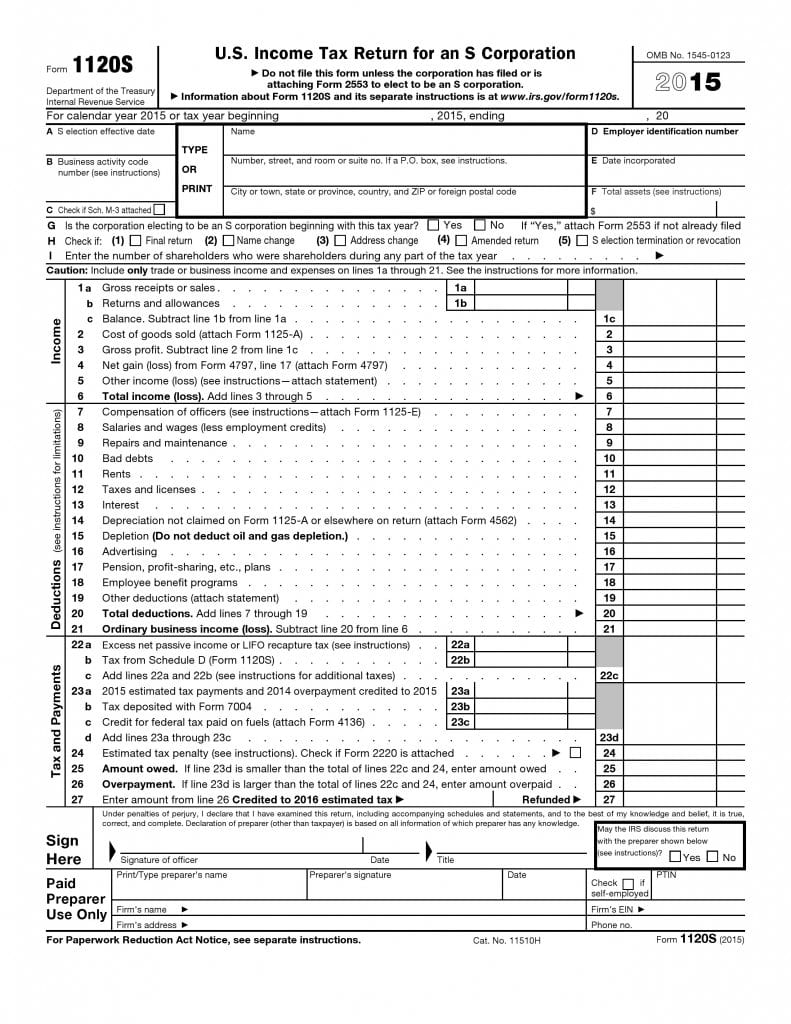

S Corporations or nominated S Corporations who file or enclose form 2553 are authorized to file their income tax returns with 1120S U.S. Income Tax Return for an S Corporation. This five-page form requires various financial particulars in Schedule B, K, L, M1, and M2.

You may choose to terminate the nomination for being an S corporation using the provision in this form. Please provide accurate and truthful particulars of income, deductions, and tax as and when requested by the form.

Steps to Prepare 1120S U.S. Income Tax Return for an S Corporation

Form 1120S

Enter the tax year, effective date of S selection, business activity code, mark box if Schedule M3 is enclosed, enter the employer identification number, date incorporated and total assets. Continue by typing or printing the name and address.

Make appropriate selection on line G, specify if form 2553 is filed, make selection on line H as applicable, and enter number of shareholders on line I.

Enter only business or trade income and expenses on lines 1 to 21. Insert values and details like gross sales, returns and allowances, cost of goods sold, net gain (loss), other income, and total income. Calculate requested details as directed.

Enter compensation of officers, salaries and wages, repairs and maintenance, bad debts, rents, taxes and licenses, interest, depreciation, depletion, advertising, pension, profit-sharing, employee benefit programs, other deductions, and calculate total deductions on lines 7 to 20. Specify ordinary business income (loss) on line 20.

Complete lines 22a through 24 to arrive at amount owned on line 25 and then enter overpayment if any on line 26. Make calculations on line 27.

Date and sign the form and select to permit or disallow discussion with the preparer. Next space requires inputs like paid preparer’s name, signature, date, firm name, address, EIN, and phone number along with selection of choices.

Schedule B – Other Information

Select accounting method and enter business activity, product, or services on line 1 and 2 respectively. Make selection on line 3 and continue to provide information on lines 4 through 13b as and when requested in the 1120S U.S. Income Tax Return for an S Corporation form. Enter these details carefully and compute the necessary values based on the instructions provided in the form.

Schedule K – Shareholders’ Pro Rata Share Items

Enter ordinary business income (loss), net rental real estate income (loss), other gross rental income, expenses from other rental activities, other net rental income, interest income, dividends, royalties, net short-term capital gain, net long-term capital gain, collectibles, unrecaptured section 1250 gain, net section 1231 gain, and other income under income (loss) section.

Continue by entering deductions on line 11 though 12d in section deductions. Then enter requested particulars of credits on line 13a through 13g. Enter requested details on line 14a through 14n under foreign transactions. Continue by entering particulars of Alternative Minimum Tax on line 15a through 15f. Then enter items affecting shareholder basis on lines 16a to 16d.

Schedule K – Shareholders’ Pro Rata Share Items

Enter other information like investment income and expenses, dividend distributions paid, other items and amounts on lines 17a through 17d. Then calculate as directed to enter Income/loss reconciliation on line 18.

Schedule L – Balance Sheets per Books

Enter particulars of assets, liabilities and shareholders’ equity in schedule l lines 1 through 14 and specify total assets on line 15. Similarly, enter the particulars of Liabilities and Shareholders’ Equity on lines 16 through 27 as requested in the form. However, enter these particulars for beginning and end of the tax years in columns a, b, c, and d.

Schedule M1 – Reconciliation of Income (Loss) per Books with Income (Loss) per Return

Enter requested inputs on lines 1 through 6a in schedule M1. Enter depreciation on line 6a and total of line 5 and 6 on line 7. Enter income (loss) on line 8 to conclude schedule M1.

Schedule M2 – Analysis of Accumulated Adjustments Account, Other Adjustments Account, and Shareholders’ Undistributed Taxable Income Previously Taxed

Enter Balance at the beginning of tax year, ordinary income, other additions, loss from line 21 of page 1, other reductions, addition of values on line 1 to 5, distributions other than dividend distributions, and calculate balance at end of tax year by deducting value of line 7 from line 6.

U.S. Income Tax Return for an S Corporation – Form 1120S

Form Preview