The Arkansas Limited Power of Attorney Form permits someone to choose another to take care of a specific financial act or obligation on his or her behalf. The action can be anything from cashing a check to purchasing real estate. Most Limited Powers of Attorney become void after completion of the act or after a fixed time period.

The donor can set out such terms and conditions as they choose. This technique allows a donor to issue separate powers of attorney with regards to individual assets and to further designate an appropriate attorney for the management of each particular asset.

It is important to use the Arkansas Limited Power of Attorney Form when completing a power of attorney, as an improperly drafter power or attorney may fail. If a power of attorney is suspect, in form or in content, a third party will usually decline to act on it.

The first 4 sections of the Arkansas Limited Power of Attorney Form are mandatory statements and do not need to be completed. The first section from completion is section V: Principal.

In this section, the donor (or ‘Principal’) enters their full name, followed by their full address where indicated.

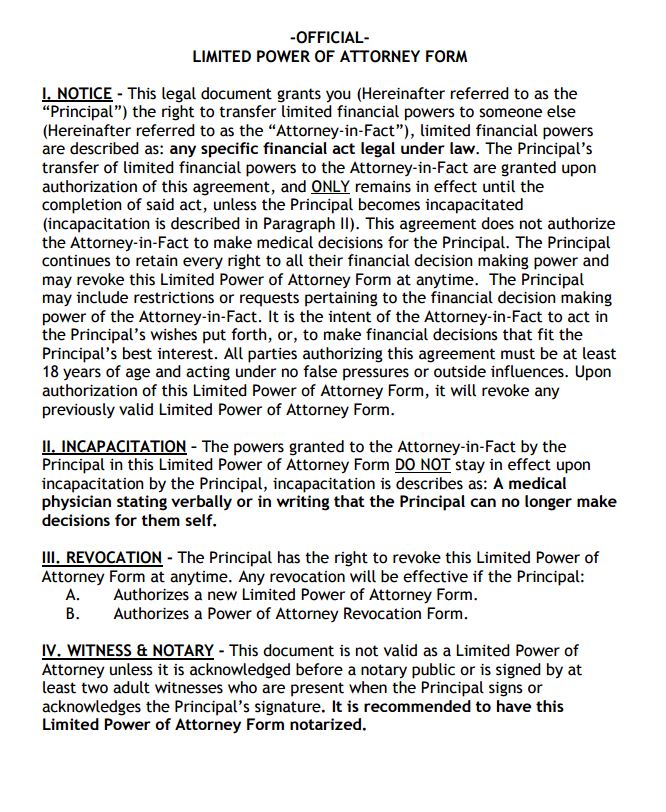

Arkansas Limited Power of Attorney Form

In the following section, section VI: Attorney in Fact the details of the attorney should be entered, starting with their full name and then their address. The state under which the power of attorney is to be enacted should then be entered (this will be Arkansas). Finally, details of the power which is being granted should be entered e.g. “all financial matters dealing with my property…” or “the sale of my vehicle…”

Section VII: Successor Attorney in Fact only needs to be completed if there is to be a secondary attorney who will act if the designated attorney is unable or unwilling too. The successor attorney in fact section should be completed in the same fashion as the above section.

The next 4 sections of the Arkansas Limited Power of Attorney Form do not require completion.

In Section XII the donor must enter their full name, date and signature. Following this, the attorney and successor attorney (where relevant) must enter their full name, sign and date sections XIII and XIV respectively.

These signatures must be made either in the presence of two witnesses, over the age of 18 or a notary public.

Where there are two witnesses, they must each print their name and sign under the ‘Witness Attestation’ section. Alternatively, a notary must notarize the document under the heading ‘Notary Acknowledgement’.

Preview of the Form