Employers Quarterly Federal Tax Return, Form 941 and Form 941-V, Payment Voucher are required during the payment of quarterly tax by an employer. You must not staple these forms and/or payment together.

Enclose check or money order payable to United States Treasury, Department of the Treasury — Internal Revenue Service along with these duly filled forms. You must complete the section requiring information about the Paid Preparer if you opt to use such services.

Form 941, quarterly federal tax return for employers has 5 parts requiring various inputs related to your personal credentials, wages paid, and tax liabilities. Completing all 5 parts duly is mandatory. You may assign a third-party designee to discuss tax matters on your behalf using the provision in part 5 of Form 941, Employers Quarterly Federal Tax Return. Form 941-V, Payment Voucher must accompany along with form 941 and payment.

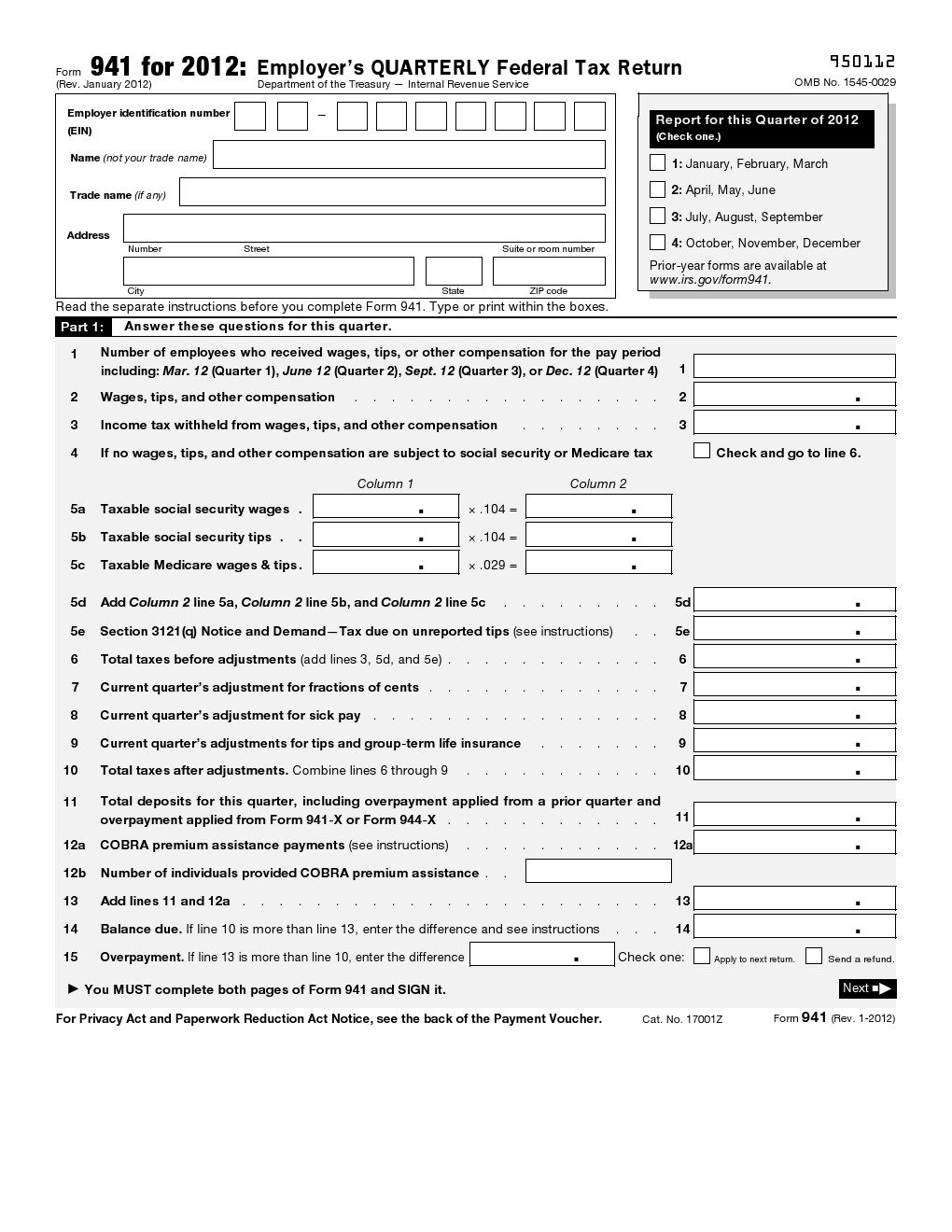

Employers Quarterly Federal Tax Return

Please enter your EIN followed by your name, trade name, and address in the boxes. Make a selection of quarter of the year by marking the appropriate box on the right side.

Part 1 – Statistics for the current quarter

- Begin by entering the number of employees on line 1.

- Enter amount of wages, tips, and any other compensation on line 2.

- Enter the total amount of income tax withheld if any on line 3.

- Go to line 6 if you select the box on line 4.

- Make calculations as directed on line 5a through 5d and enter information on line 5e if applicable.

- Calculate taxes before adjustments as directed on line 6.

- Calculate this quarter’s adjustments for fractions of cents, sick pay, and tips and group-term life insurance on line 7, 8, and 9 respectively.

- Enter total taxes after adjustments on line 10 as directed.

- Type total deposits in this quarter on line 11 and provide details of COBRA Premium assistance on line 12a and 12b.

- Make calculations on line 13, 14, and 15 as directed and mark your response to send a refund or apply to next return.

Part 2 – Deposit Schedule & Tax Liability

Please enter your name and EIN on the foremost space on page 2 of Form 941, Employers Quarterly Federal Tax Return. Select one option among three in part 2, line 16. You need to provide a tax liability for each month of the quarter if you select the second box. Enter your total liability for the quarter in the last box and select the next box if you were a semiweekly schedule depositor.

Part 3 – Information About Your Business

Select box on line 17 if you have stopped paying wages and/or your business is currently closed. Then insert date of last wage payment in the next box. Proceed to line 18 and mark the box if you do not file Employers Quarterly Federal Tax Return for every quarter of the year.

Part 4 – third-party designee

Mark the box in confirmation and enter designee’s name and phone number along with a 5 digit PIN or select the next box to indicate no otherwise.

Part 5 – Signature and Paid Preparer Information

Sign in the box in Part 5, insert date below the signature and print your name, title, and phone number in the respective spaces. The next section requires input by Paid Preparer if any like name, signature, firm name if any, address, PTIN, date, EEIN, and phone number. Mark the box if the Paid Preparer is self-employed.

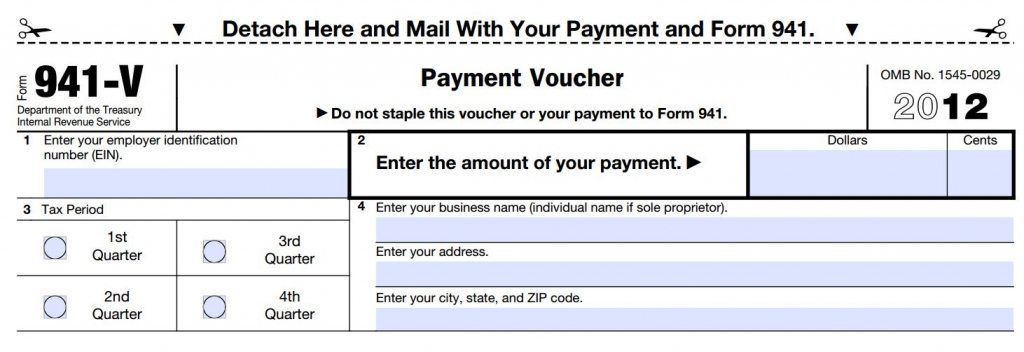

Form 941-V Payment Voucher

Insert your EIN and amount of tax payment in dollars and cents as applicable on line 1 and 2 respectively. Darken the circle to indicate the quarter for tax payment on line 3. Now proceed to line 4 and enter your business name or individual name in case you are a sole proprietor, then enter your address, city name, state, and zip code.

Preview Employers Quarterly Federal Tax Return