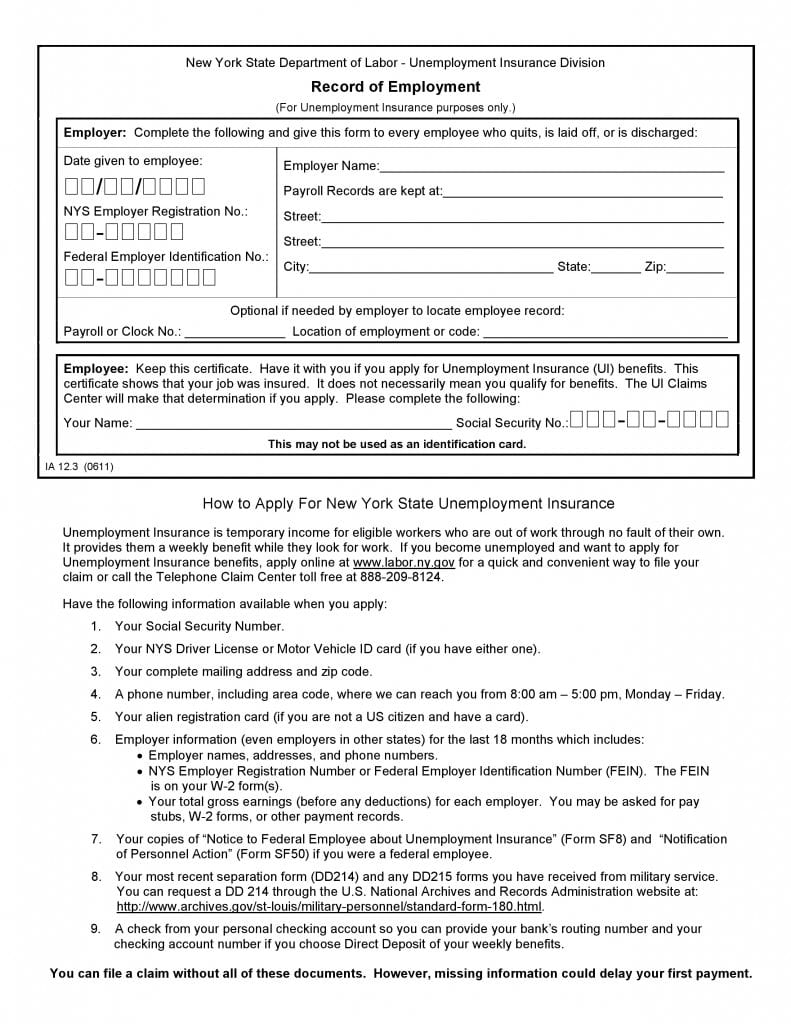

The IA12.3 Record of Employment is a document intended to declare that the employee’s job was insured and the employee is entitled to apply for Unemployment Insurance Benefits upon the forcible layoff or termination from a job when the said employee is at no fault. This form also serves as a certificate, however, not as identification.

The employer issues this Form IA12.3 to the employee upon the termination. The employee is subjected to provide documents mentioned in 1 through 9 during the application for claiming Unemployment Insurance Benefits with the New York State Department of Labor, Unemployment Insurance Division. The employee may choose to apply online or via toll free phone number to claim Unemployment Insurance Benefits.

Before Proceeding

- Form IA12.3 Record of Employment is issued by the employer

- The employer may choose to locate an employee record by providing necessary details in the second section of the Form IA12.3

- Fill all details completely and accurately.

- An employee cannot use Form IA12.3 as a certified identification or proof of identity.

- This Form IA12.3 is required during filing the claim for Unemployment Insurance Benefits with the Unemployment Insurance Division of the New York State Department of Labor.

Record of Employment – Employer

This portion of the form IA12.3 is filled by the employer. Please proceed by entering the date as given to the employee, NYS Employer Registration Number, and Federal Employer Identification Number (FEIN) in the respective boxes on the left side of the form. Then enter employer’s legal name as on the records, location of keeping Payroll Record, street address, name of the city, name of the state, and zip code on the respective lines. You as an employer may choose to provide the Payroll or Clock number and location of employment or code in the spaces provided for the same in case you need to locate an employee record.

Record of Employment – Employee

The next section of form IA12.3 Record of Employment seeks input about the employee like the name of the employee and the SSN of the employee in the respective spaces. You may choose to type or print the required information in block capital letters for legibility.

The employee may need to provide the SSN, Driver’s License Number, Motor Vehicle ID Card, Mailing Address and Zip Code, Daytime Phone Number, Alien Registration Card in case you are not a US citizen, Employer Information, form SF8, SF50, DD214, and DD215 along with a your personal checking account check while filing a claim for Unemployment Insurance Benefits.

New York Record of Employment – IA12.3

Preview Form