T1 General Income Tax and Benefit Return Form Alberta, Canada is intended to facilitate a taxpayer to furnish particulars of the income, tax, and refund/owing if any. The document has 9 prominent heads requiring personal as well as financial inputs like gross, net, and taxable income. You as a taxpayer can choose to pay tax by check or money order enclosed with the form or alternatively pay tax online too.

Filling all particulars accurately is mandatory. Form T1 General requires various computations to arrive at conclusions about the gross, net, and taxable income. Use directives offered in each section requiring computing while preparing the form. You may need to furnish particulars of the Preparer when applicable. Submit duly completed form along with supporting documents and other forms to the Canada Revenue Agency.

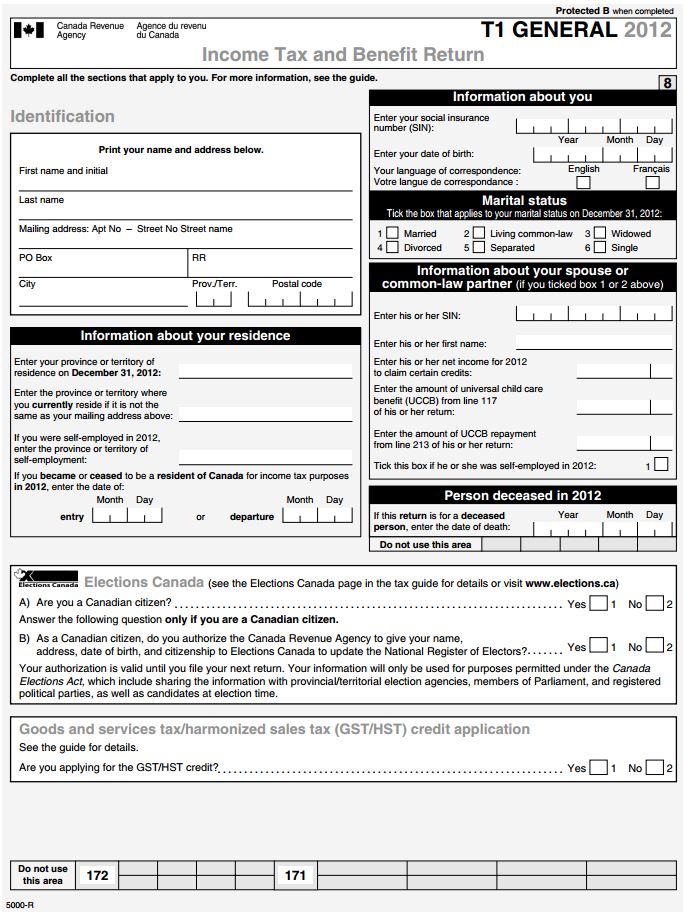

Start by providing your identification like name, mailing address, social security number, date of birth, marital status, and information about your residence along with the month and year of entry or departure in line with your Canadian residency status. You need to provide particulars of your spouse upon selection of choice 1 or 2 for your marital status. Provide particulars like social insurance number of spouse followed by name, net income, the amount of UCCB, amount of UCCB repayment, and mark the box if the spouse was self-employed during the tax year.

Mark your response between 1 or 2 in Election Canada section for both the questions.

Select yes if you are applying for GST/HST credit or no otherwise in Goods and Services Tax/Harmonized Sales Tax Credit Application section.

Mark yes, if you own foreign property with cost more than CAN$100,000 and submit duly completed form T1135 along with the form or mark no when not applicable.

Continue by providing particulars of Total Income. Furnish each detail carefully and now proceed to the next one. Follow directives for addition of incomes and complete this section accordingly to arrive at the value of total income as specified on line 150. You may need to refer to T4A(OAS), T4A(P), T1032, T4E, T4RSP, and T5007 slips for particulars as and when needed.

Next section of the form is intended to compute net income. Complete this section step-by-step and use directives mentioned on the form to compute net income as concluded on line 236. You may need to refer to T4, T4A, T1032, RC62 slips, T778, and T1229 forms for inserting particulars.

Calculate Taxable Income in the next section by inserting particulars on each line from line 244 through 256 to arrive to line 260 taxable income. Use directives mentioned in each subsection for calculation. Continue by calculating Refund or Balance Owing in the next section. Insert values in line 420 through 428 to arrive to At Payable Tax in line 435. Continue from line 437 through 479 to arrive to total credits in line 482. Subtract 482 from 435 to compute the refund or balance owing. Complete lines 484, 485, and 486 as applicable.

Section Direct deposit – Start or change needs input only upon the variance of particulars. Complete line 460 through 491 as applicable.

The last portion of the form has space reserved for your signature as a taxpayer, phone number, and date along with space for furnishing particulars of Preparer like name, phone number, and EFILE number when applicable.

Alberta Canada Revenue Income Tax and Benefit Return Form

Form Preview