Form PTAX-203 Illinois Real Estate Transfer Declaration is an instrument intended to facilitate the transfer of a real estate property from the seller to the buyer. Submitting duly completed Form PTAX-203 is mandatory even when a tax exemption is demanded.

The Real Estate Transfer Tax Law (35 ILCS 200/31-1 et seq.) governs the transfer of real estate in the state of Illinois. Form PTAX-203 furthermore is necessary for computation of taxes. Use guidelines in Step 2 for the computation of taxes. Furnish detailed description of the property in step 3 as per the deed.

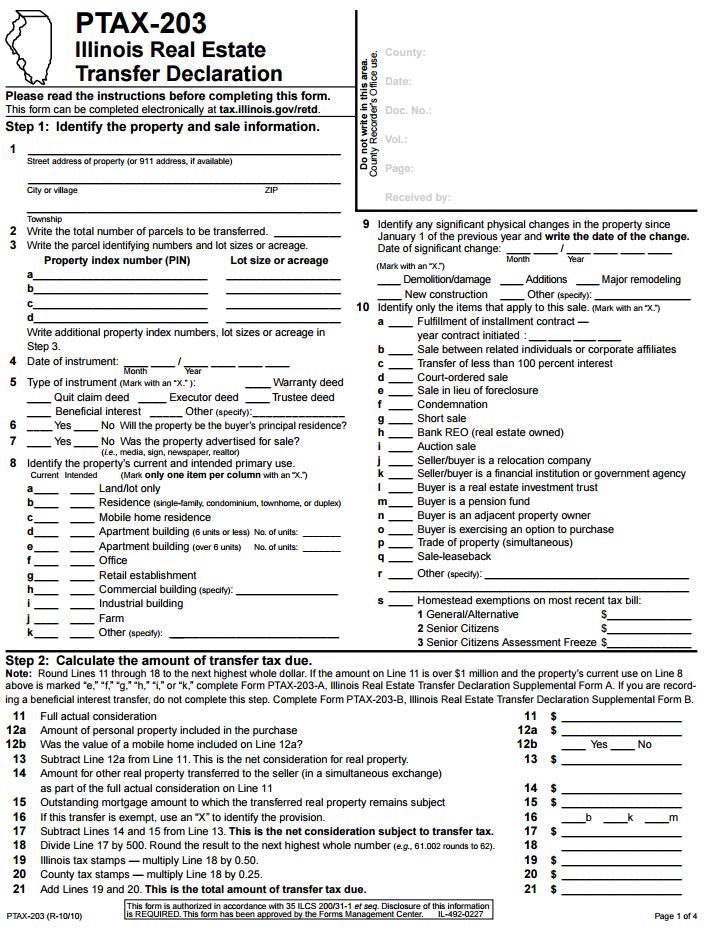

Begin by typing the street address, city/village, township, and Zip code of the property. Enter the number of parcels in 2. Furnish Property index number and Lot size or acreage for each parcel in 3a to 3d as applicable. Mention date of instrument on line 4. Select the right type of the instrument with an X mark and specify the other if you select so on line 5. Make X marks on line 6 and 7 to select residential status and advertising made if any. Specify the current and intended use of the said property through 8a to 8k. Specify type of commercial building and others if you select so. Furnish number of units in 8d and 8e if applicable. Write date of significant change in the property, if any on line 9 and check the appropriate type by making x mark. Specify in detail if you select other. Line 10 seeks the selection of applicable choices from 10a to 10s. Furnish particulars of Homestead Exemptions if any, in 10s1 to 10s3.

Illinois Real Estate Transfer Declaration PTAX-203

Skip Step 2 if you are recording a beneficial interest transfer; otherwise specify applicable particulars from line 11 to line 21. Compute taxes as directed on line 13, 17, 18, 19, 20, and 21 to complete Step 2. Compute taxes carefully in step 2. Line 21 declares the amount of transfer tax owed.

Proceed to Step 3 by furnishing legal description of the property as specified in the deed. Alternately, you can attach the property description from the deed as instructed in Step 3 of PTAX-203 Illinois Real Estate Transfer Declaration Form.

Step 4 requires particulars of Seller, Buyer, and Preparer. Please print all particulars called for in Step 4. Continue by providing seller/trustee’s name, street address, city, state, and zip code. Furnish after sale street address and specify trust number of the seller if any. Trust number is not FEIN or SSN. Sign in the space provided and insert date. Print Buyer’s information like buyer’s/trustee’s name, buyer’s trust number if applicable, street address after sale, city, state, and zip code. Complete furnishing buyer’s information by signing in the appropriate field, inserting the date, and specifying the name, street address, city, state, and zip code for mailing tax bills. Specify preparer’s information like name and/or company name, file number if necessary, street address, city, state. zip code, daytime phone number, and email address in the respective fields along with the signature of the Preparer.

Complete form-PTAX-203 Illinois Real Estate Transfer Declaration by providing particulars of supporting documents enclosed like extended legal description, itemized list of personal property, Form PTAX-203-A, Form PTAX-203-B as applicable and necessary. Leave last section blank for completion by the Chief County Assessment Officer.

Form Preview