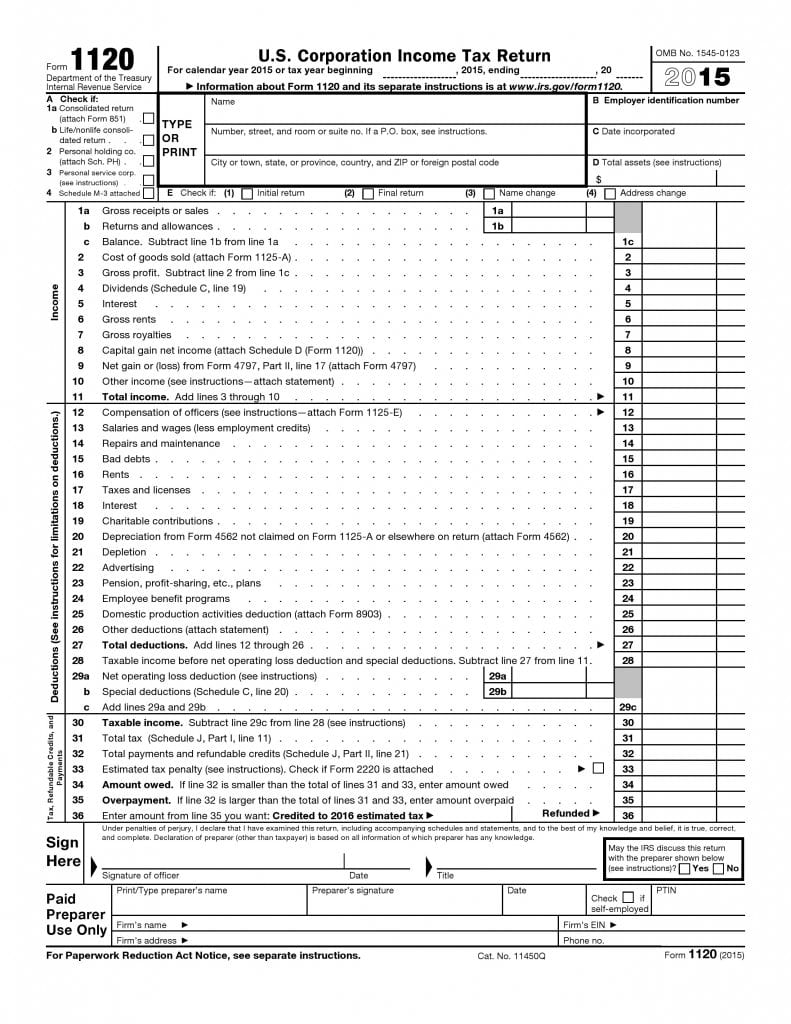

Please file corporate income tax returns using Form 1120 U.S. Corporation Income Tax Return. This five-page form requests various inputs on your financial particulars. Please read this form carefully to understand its requirements.

Omissions and strikeouts are not permitted. This form contains form 1120 along with Schedules C, J, K, L, M-1, and M-2. Filling details in form 1120 and its Schedules is mandatory. You need to enter values and make selection of options by selecting appropriate boxes.

Steps to prepare Form 1120 U.S. Corporation Income Tax Return

Form 1120

- Enter tax year, type or print your name, and address. Make selection of the right option for E1 through E4 and A1 through A4 as applicable. Enter Employer Identification Number, date of incorporation, and total assets on lines B, C, and D respectively.

- Enter income details like Gross receipts or sales, returns and allowances, and balance on 1a, 1b, and 1c respectively. Give details of cost of goods sold, gross profit, dividends, interest, gross rents, gross royalties, capital gain net income, net gain, and other income on lines 2 to 10 respectively. Enter total income on line 11.

- Provide details of deductions like compensation of officers, salaries and wages, repairs and maintenance, bad debts, rents, taxes and licenses, interest, charitable contributions, depreciation, depletion, advertising, plans , employee benefit programs, domestic production activities deduction, and mention other deductions on lines 12 to 26 respectively. Enter total deductions on line 27. Enter taxable income as requested on line 28. Complete computation as required on lines 29a through 29c.

- Enter taxable income, total tax, payments and refundable credits, estimated tax penalty, amount owed, overpayment, credited to 2016 estimated tax, and amount refunded on the respective lines 30 to 36.

- Enter title, date, and sign form 1120. Continue by entering preparer’s name and signature along with firm name, EIN, address, and phone number.

Schedule C – Dividends and Special Deductions

Enter particulars of dividends on line 1 through 8 as requested. Continue by adding the total of values entered on lines 1 to 8 on line 9. Enter the amounts of dividends as needed on line 10 to 18. Enter total dividends on line 19. Continue by entering the amount of total special deductions on line 20.

Schedule J – Tax Computation and Payment

Part I–Tax Computation of Schedule J requires information like income tax, alternative minimum tax, foreign tax credit, credit from form 8834, general business credit, credit for prior year minimum tax, bond credits from form 8912, total credits, personal holding company tax on lines 1 though 8. Then enter amounts of recapture of investment credit, recapture of low-income housing credit, interest due, alternative tax on qualifying shipping activities, and other along with the total of all taxes on lines 9 through 11 in addition to computations requested. Enter amounts as requested on lines 12 through 21 in Part II–Payments and Refundable Credits.

Schedule K – Other Information

Provide other information like check accounting method, business activity code, business activity, and product or service on line 1 and 2 respectively. Then continue by providing requested information on lines 3 through 18 to complete preparation of Schedule K. Please follow instructions for computations and making a selection of choices.

Schedule L – Balance Sheets per Books

Schedule L requires information of assets on lines 1 through 15. Enter the values for beginning and end of the tax year in Schedule L. Continue by providing details of Liabilities and Shareholders’ Equity on lines 16 to 27 for beginning and end of the tax year. Compute total liabilities and shareholders’ equity on line 28.

Schedule M1 – Reconciliation of Income (Loss) per Books with Income per Return

Provide values and particulars required on lines 1 through 9. Enter income on line 10 after the calculations as directed in Schedule M1. In addition, you may require filing Schedule M3 as a Corporation.

Schedule M2 – Analysis of Unappropriated Retained Earnings per Books

Refer to Schedule L and line 25 for particulars and values in Schedule M2. Please enter details and amounts on line 1 through 6, add total values on lines 1 to 6 on line 7, and enter balance at the year-end on line 8.

U.S. Corporation Income Tax Return Form 1120

Form Preview