Filing Kansas Business Tax Application with Kansas Department of Revenue is necessary while starting a new business, acquiring an existing business, or during the registration of additional tax type/s. Please file duly completed tax application with Kansan Department of Revenue at Topeka, KS 66612-1588 or alternately fax it on (785) 291-3614.

You need to provide particulars concerned about your business only. Please leave unrelated parts of this application blank. Please enter all particulars accurately in this 12-part form. You may choose to send a check or electronic payment along with the business tax application for businesses within the jurisdiction of Kansas State. In addition, you must provide your SSN or EIN on each page of the form. All owners, directors, corporate officers, and partners must date and sign this form in separate spaces before filing.

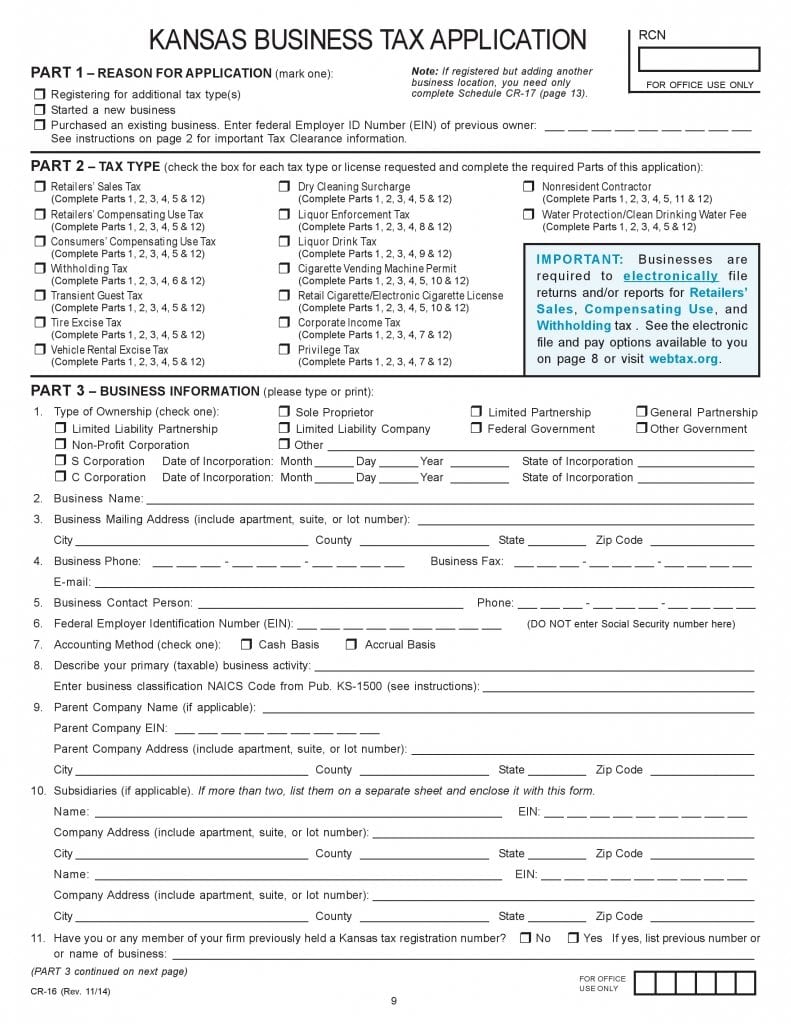

Steps to prepare Kansas Business Tax Application

Part 1 – Reason for Application

Please select only one option among three offered and enter EIN of the previous owner if you select option 3.

Part 2 – Tax Type

You must select the most appropriate tax types from the 16 options offered. You are authorized to select more than one option when applicable.

Part 3 – Business Information

- Select type of ownership on line 1 and proceed to line 2 to enter the business name. Provide mailing address on line 3. Continue by entering phone and fax number as well as email address on line 4.

- Specify name of contact person and his/her phone number followed by his/her EIN on lines 5 and 6 respectively.

- Specify accounting method on line 7 along with business activity and business classification NAICS code on the next line. Enter parent company name, EIN, and address if applicable. Provide name, address, and EIN of the subsidiary if any on line 10.

- Enter previous tax registration number and company name if previously registered with Kansas Department of Revenue or leave blank otherwise.

- Provide all Kansas registration numbers you are using on line 12.

- Provide closed registration numbers due to filing this application.

- Select yes and provide your SST ID if you are registered with SST or select no otherwise.

Part 4 – Location Information

Part 4 – Location Information requires input of business trade name, address, name of the city if located within city limits, primary business activity, NAICS code, and phone number on lines 1 to 5. Select appropriate options if you rent motor vehicles or operate a motel on lines 6 and 7 respectively. Select if you sell tires or are a laundry retailer on lines 8 and 9. Select if you sell water or fuel on lines 10 and 11.

Part 5 – Sales/Compensating Use Tax

Enter date, permanent location, temporary location if any, mode of delivery, merchandise purchase option, estimated annual sale, and months of operation in case of seasonal business on lines 1 to 7 respectively. Provide information of labor services and the sale of electricity, natural gas, or heat on lines 8 and 9.

Part 6 – Withholding Tax

Enter date for making payments, estimated Kansas withholding tax, and information of Payroll Company if applicable on lines 1 through 3 respectively.

Part 7 – Corporate Income Tax or Privilege Tax

Enter date of starting operations, name and EIN, select financial institution type, type of tax year, and type of business on lines 1 through 5.

Part 8 – Liquor Enforcement Tax

Enter the date of the first alcoholic liquor sale and select types of licenses from available options.

Part 9 – Liquor Drink Tax

Enter the date of the first alcoholic beverages sale and select types of licenses from available options.

Part 10 – Cigarette and Tobacco Tax

Provide information about the sale of cigarettes if your business is involved in selling them on lines 1 through 5 or leave blank otherwise.

Part 11 – Nonresident Contractor

Use a separate page to provide information requested on 1 to 8 for each contact if your business is involved in contracting and/or subcontracting. Leave part 11 blank if you are not involved in contracting.

Part 12 – Ownership Disclosure and Signature Statement

Furnish requested details, date, and sign on part 12, Ownership Disclosure and Signature Statement. Each owner, director, corporate officer, and partner must sign this Kansas Business Tax Application individually in separate spaces.

Kansas Business Tax Application

Form Preview