Department of Taxation of Hawaii State permits you to appoint attorney-in-fact / representative to handle tax affairs on your behalf when you prepare and execute form N-848, Hawaii Tax Power of Attorney. The appointed representative is permitted to represent you before the Hawaii Department of Taxation exclusively for the tax matters described in this document.

You must submit a duly completed and signed power of attorney with the Department of Taxation for its execution. You may choose to provide acts authorized and instructions pertaining to retention or termination of previously filed power of attorney with the Department of Taxation using the provisions in this power of attorney form. You, co-tax payer, and all representatives must sign and date in part I and II of this document in acceptance to it before filing it with the Department of Taxation.

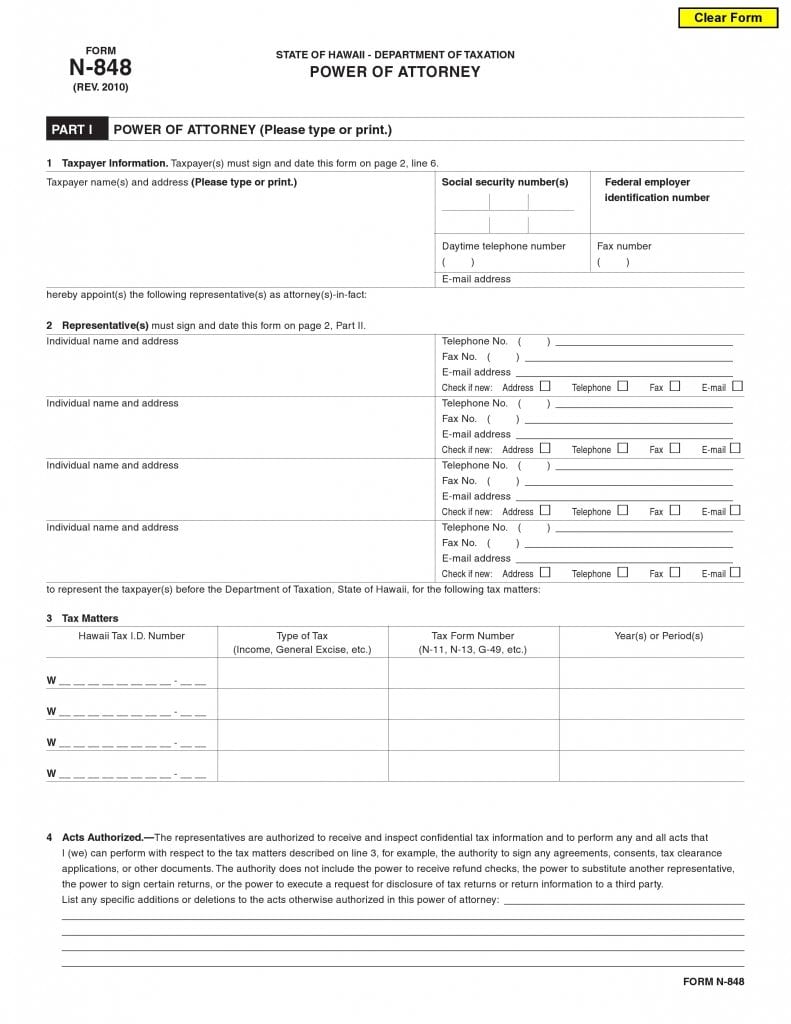

Hawaii Tax Power of Attorney Form

Steps to prepare Hawaii Tax Power of Attorney

Part I

Step 1: Enter taxpayer information like your name, address, SSN, Federal Employer Identification number, daytime phone number, fax number, and email address. You must provide these particulars of all co-taxpayers when there is more than one.

Step 2: You may choose to appoint several representative to handle various tax affairs. However, you must provide particulars of each representative separately. Give information like name and address of each representative along with the phone number, fax number, and email address. You must mark the box if the address, phone number, email address, and fax number is new as applicable.

Step 3: Provide information about tax matters you want to allocate to the representative/s to represent you before Department of Taxation. You must provide Hawaii Tax I.D. Number, Tax type like Excise, General, Income, etc., applicable tax form number, and year of tax or tax period in the respective spaces. Please provide particulars of each tax affair on a separate line.

Step 4: Mention detailed deletions or additions to the acts authorized otherwise in this Hawaii Tax Power of Attorney form N-848 in Acts Authorized section of the form. Please strike out blank lines if any.

Step 5: Filing this legal document revokes all previously issued tax power of attorneys. However, you may choose to keep any previously issued power of attorney in effect by specifying its details. Please enclose a copy of the old power of attorney while filing this form N-848.

Step 6: You and any co-tax payer must date and sign this Hawaii Tax Power of Attorney form N-848 along with entering printed name. Mention title when applicable.

Part II

Each designated representative must sign this Hawaii Tax Power of Attorney form N-848 on a separate line in addition to providing particulars like last four digits of SSN, typed or printed name, and date. Signing part II of the form N-848 tax power of attorney is mandatory for each representative.

Form Preview