The Florida Durable Financial Power of Attorney Form is a legal document that allows an individual (the “Principal”) to appoint another person (the “Attorney-in-Fact”) to manage their financial affairs. This form remains effective even if the Principal becomes incapacitated, ensuring continuous management of financial matters.

Why Use the Florida Durable Financial Power of Attorney Form?

The Florida Durable Financial Power of Attorney Form is essential for individuals who want to ensure that their financial affairs are managed in their best interest, even if they are unable to do so themselves. This form grants the Attorney-in-Fact the authority to handle various financial transactions, ensuring that the Principal’s financial matters are taken care of without interruption. This is particularly useful for those who anticipate being unable to manage their finances due to illness, travel, or other reasons.

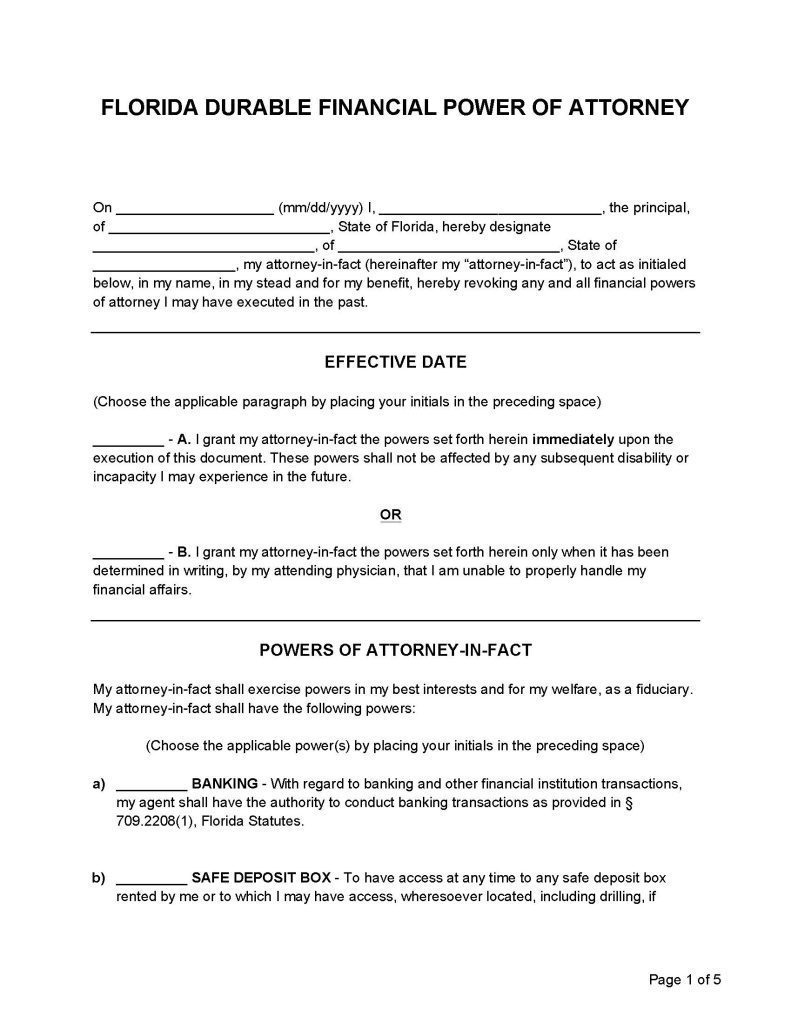

Florida-Durable-Financial-Power-of-Attorney Form

How to Fill Out the Florida Durable Financial Power of Attorney Form

Follow these steps to complete the Florida Durable Financial Power of Attorney Form accurately:

- Principal and Attorney-in-Fact Information:

- Enter the date of execution.

- Provide the full legal name and address of the Principal.

- Provide the full legal name and address of the Attorney-in-Fact.

- Effective Date:

- Choose when the power of attorney becomes effective by initialing the appropriate option:

- Option A: Powers are effective immediately upon execution.

- Option B: Powers are effective only upon the determination of the Principal’s incapacity by their attending physician.

- Choose when the power of attorney becomes effective by initialing the appropriate option:

- Powers Granted:

- Initial the line in front of each power you wish to grant to the Attorney-in-Fact:

- Banking: Authority to conduct banking transactions.

- Safe Deposit Box: Access to safe deposit boxes.

- Lending or Borrowing: Authority to make loans or borrow money.

- Government Benefits: Authority to apply for and receive government benefits.

- Retirement Plan: Authority to manage retirement plans.

- Taxes: Authority to handle tax matters.

- Insurance: Authority to manage insurance policies.

- Real Estate: Authority to handle real estate transactions.

- Personal Property: Authority to handle personal property transactions.

- Property Management: Authority to manage property.

- Gifts: Authority to make gifts.

- Legal Advice and Proceedings: Authority to obtain legal advice and handle legal proceedings.

- Initial the line in front of each power you wish to grant to the Attorney-in-Fact:

- Special Instructions:

- Specify any limitations or extensions of the powers granted to the Attorney-in-Fact in the space provided.

- Principal’s Signature and Notarization:

- The Principal must sign and date the document.

- The form must be signed in the presence of a notary public, who will acknowledge the signature.

- Witness Signatures:

- Two witnesses must sign the document, affirming that the Principal signed it willingly and in their presence. They must also provide their printed names and addresses.

- Attorney-in-Fact’s Acceptance:

- The Attorney-in-Fact must sign the acceptance of appointment, acknowledging their responsibilities.

- Notarization of Attorney-in-Fact’s Signature:

- The Attorney-in-Fact’s acceptance must also be notarized.

The Florida Durable Financial Power of Attorney Form is a vital document for anyone seeking to ensure their financial matters are handled by a trusted individual, even if they become incapacitated. This form provides broad powers to the Attorney-in-Fact, covering various aspects of financial management.

Preview Florida Durable Financial Power of Attorney Form